TheSmartApe🔥

No content yet

TheSmartApe🔥

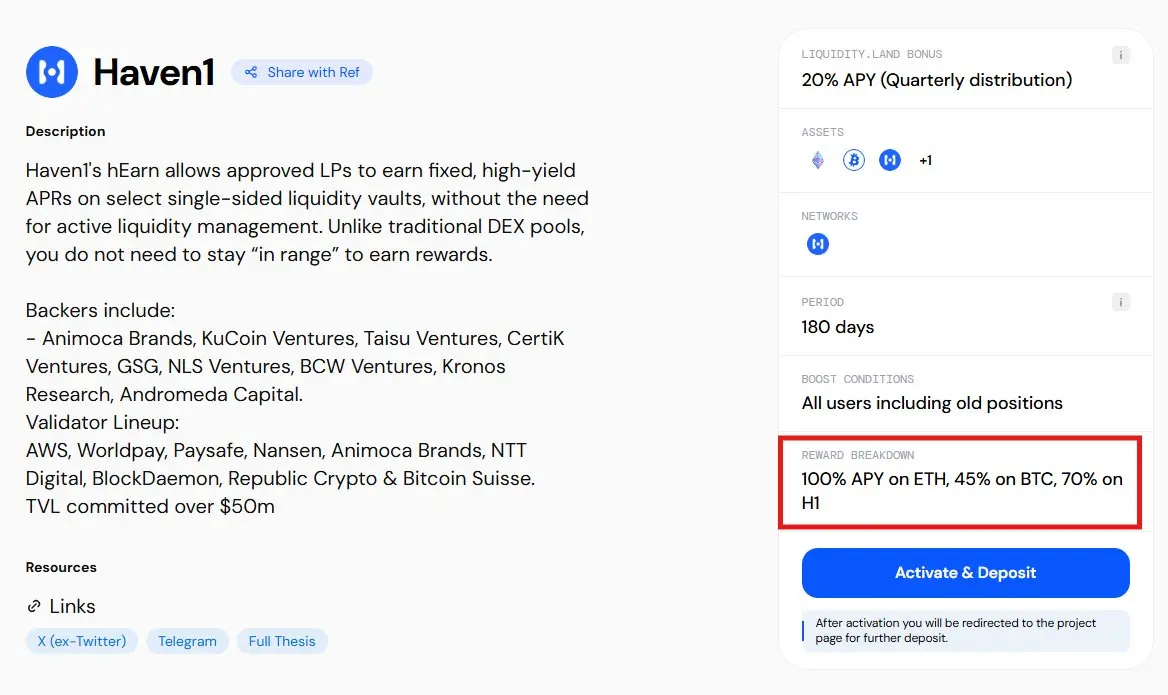

Camp = LEGO + Midjourney + Stripe, all into one app.

The Mimi & Neko campaign from @campnetworkxyz shows that you no longer need to be Disney or Pixar to work with major IPs.

Camp says, “Here’s a popular IP, it’s open, it’s onchain, go build with it.”

It’s like getting a LEGO set and being free to rearrange the pieces however you want.

You don’t even need to be an artist, just use your ideas with prompts to generate new versions of the characters.

It’s like using Midjourney to remix or create an image from an existing one.

And you get paid automatically whenever your remix is used.

The smart c

The Mimi & Neko campaign from @campnetworkxyz shows that you no longer need to be Disney or Pixar to work with major IPs.

Camp says, “Here’s a popular IP, it’s open, it’s onchain, go build with it.”

It’s like getting a LEGO set and being free to rearrange the pieces however you want.

You don’t even need to be an artist, just use your ideas with prompts to generate new versions of the characters.

It’s like using Midjourney to remix or create an image from an existing one.

And you get paid automatically whenever your remix is used.

The smart c

- Reward

- like

- Comment

- Share

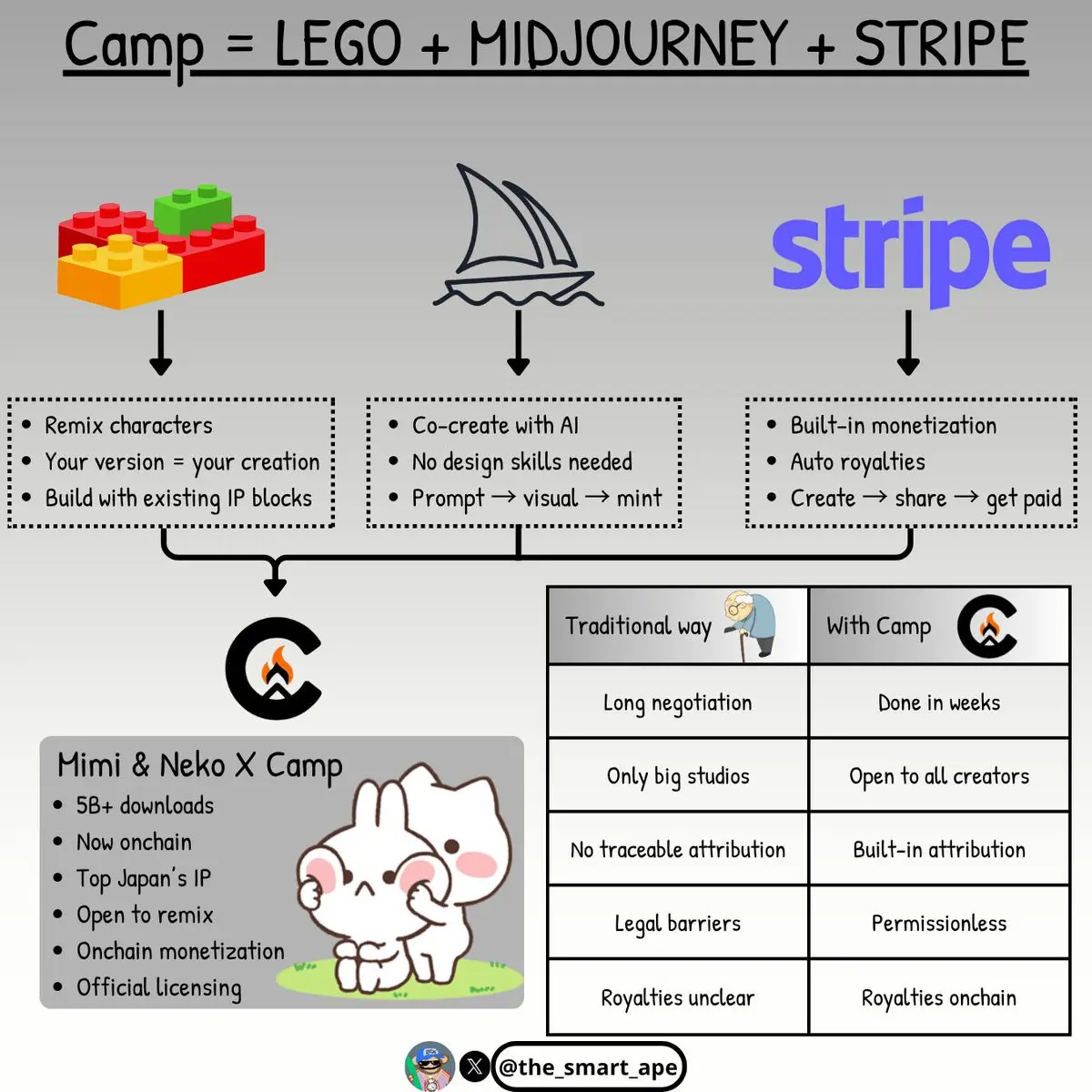

AI can’t function without being trained on data that you create.

So in a way, it’s forced to “watch” you to become better.

Camp acts like a gatekeeper, just like OnlyFans, but for AI, it lets you control access to your content using smart contracts.

+ You decide who can access what

+ You set royalties based on how your content is used

+ No more silent data scraping, your content, your rules

So in a way, it’s forced to “watch” you to become better.

Camp acts like a gatekeeper, just like OnlyFans, but for AI, it lets you control access to your content using smart contracts.

+ You decide who can access what

+ You set royalties based on how your content is used

+ No more silent data scraping, your content, your rules

MORE-14.29%

- Reward

- like

- Comment

- Share

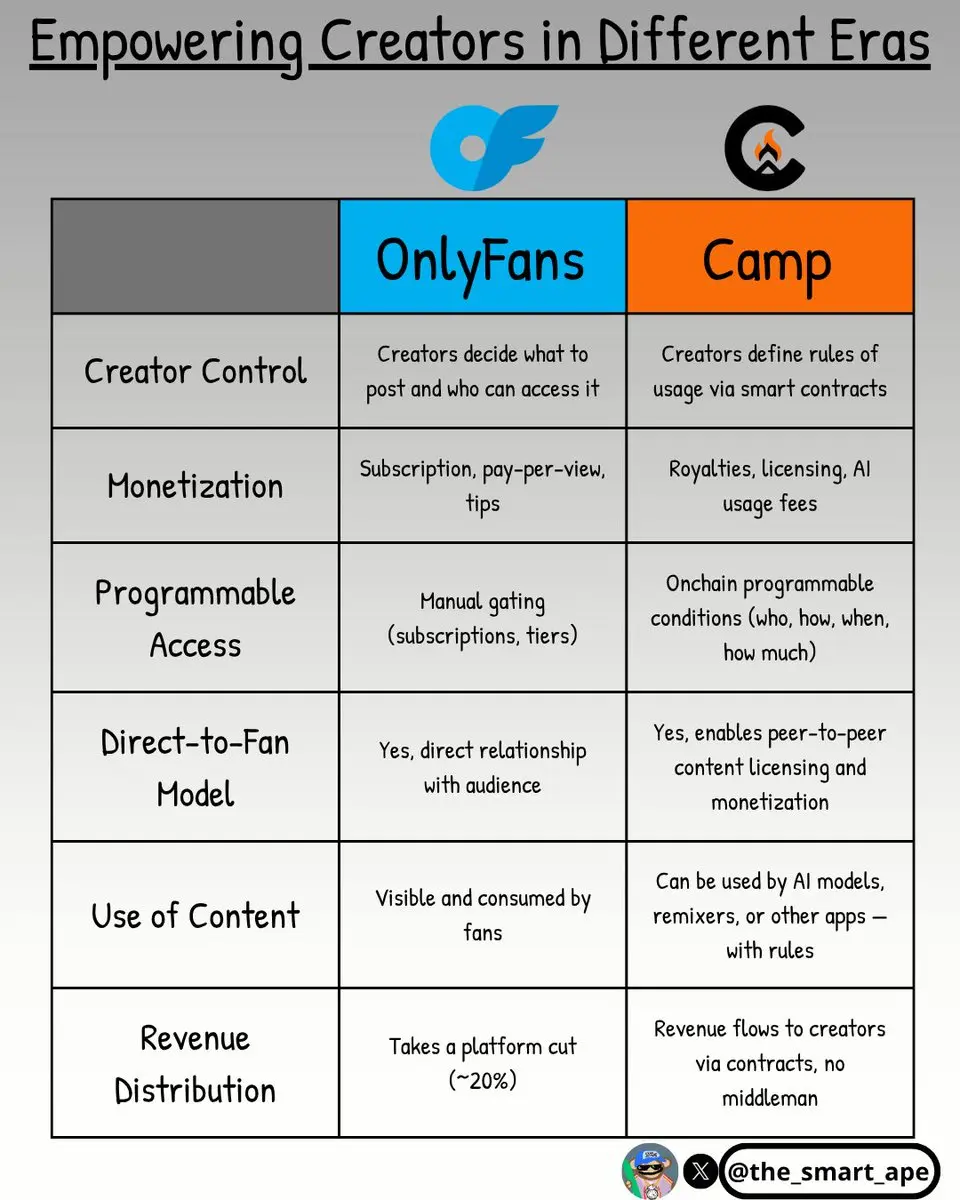

Honestly, I can’t think of a more fun way to earn high yields on stablecoins.

Here’s how it works:

1/ Buy PT sUSDf on Pendle

This already gives you a fixed 14.4% APY at maturity.

But let’s be honest, 14% alone isn’t enough. We’re here for leverage.

2/ Lend PT sUSDf on Silo

You won’t earn extra yield from lending, but it allows you to borrow USDC at an 8% cost.

3/ Borrow USDC with PT-sUSDf collateral

4/ Use the borrowed USDC to buy more PT sUSDf

Then simply repeat the cycle from step 1, and that’s your yield loop complete.

Here’s how it works:

1/ Buy PT sUSDf on Pendle

This already gives you a fixed 14.4% APY at maturity.

But let’s be honest, 14% alone isn’t enough. We’re here for leverage.

2/ Lend PT sUSDf on Silo

You won’t earn extra yield from lending, but it allows you to borrow USDC at an 8% cost.

3/ Borrow USDC with PT-sUSDf collateral

4/ Use the borrowed USDC to buy more PT sUSDf

Then simply repeat the cycle from step 1, and that’s your yield loop complete.

- Reward

- like

- 1

- Share

Stocks :

:

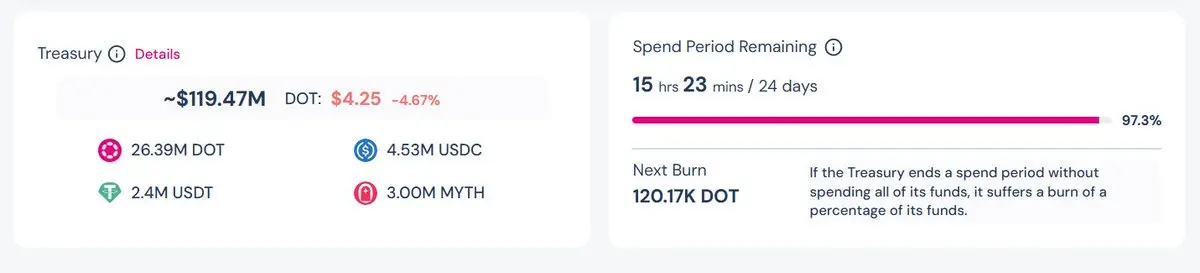

What about the risks, is there a risk of total loss?Name one chain that gives its treasury to the community and lets them spend it freely.

+ It also encourages the community to spend it. If they don’t use it within a specific period, part of the treasury gets burned.

+ It also encourages the community to spend it. If they don’t use it within a specific period, part of the treasury gets burned.

DON-5.2%

- Reward

- like

- Comment

- Share

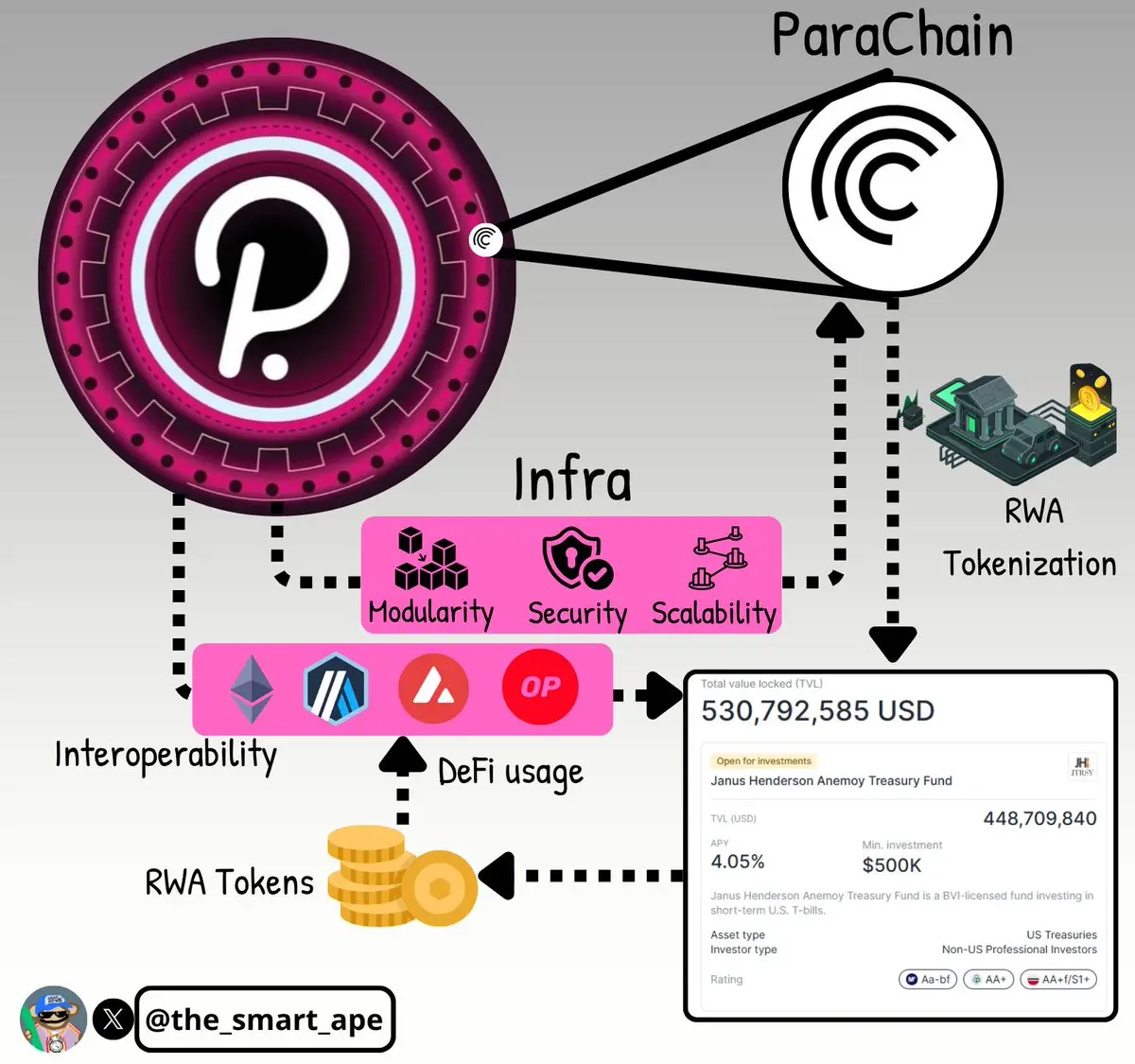

The biggest thing coming in crypto is RWA.

We don’t need an alt season, RWA alone is enough.

RWA demands infrastructure and flexibility, and Polkadot delivers both.

As a parachain, Centrifuge benefits from the shared security of Polkadot’s validator set, no need to maintain its own validator network.

Thanks to Polkadot’s interoperability, Centrifuge can also connect with other ecosystems like Ethereum, Arbitrum, and Avalanche, unlocking external DeFi liquidity with ease.

We don’t need an alt season, RWA alone is enough.

RWA demands infrastructure and flexibility, and Polkadot delivers both.

As a parachain, Centrifuge benefits from the shared security of Polkadot’s validator set, no need to maintain its own validator network.

Thanks to Polkadot’s interoperability, Centrifuge can also connect with other ecosystems like Ethereum, Arbitrum, and Avalanche, unlocking external DeFi liquidity with ease.

- Reward

- like

- Comment

- Share

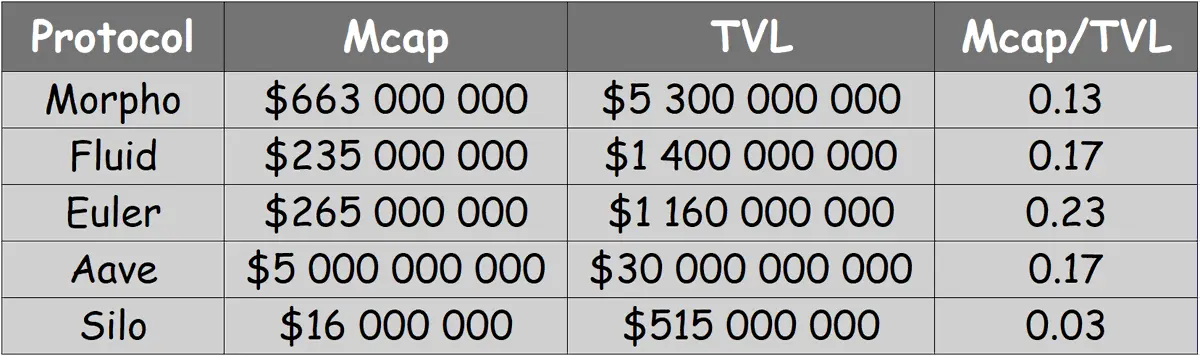

Is it just me, or $SILO is completely mispriced?

During the hyper DeFi phase on Sonic, they delivered tons of yield opportunities, and now they’re doing the same on Avalanche.

What really surprises me is the Mcap, just $16M, with a $38M FDV. That puts the Mcap/TVL ratio at 0.03, one of the lowest in the space right now.

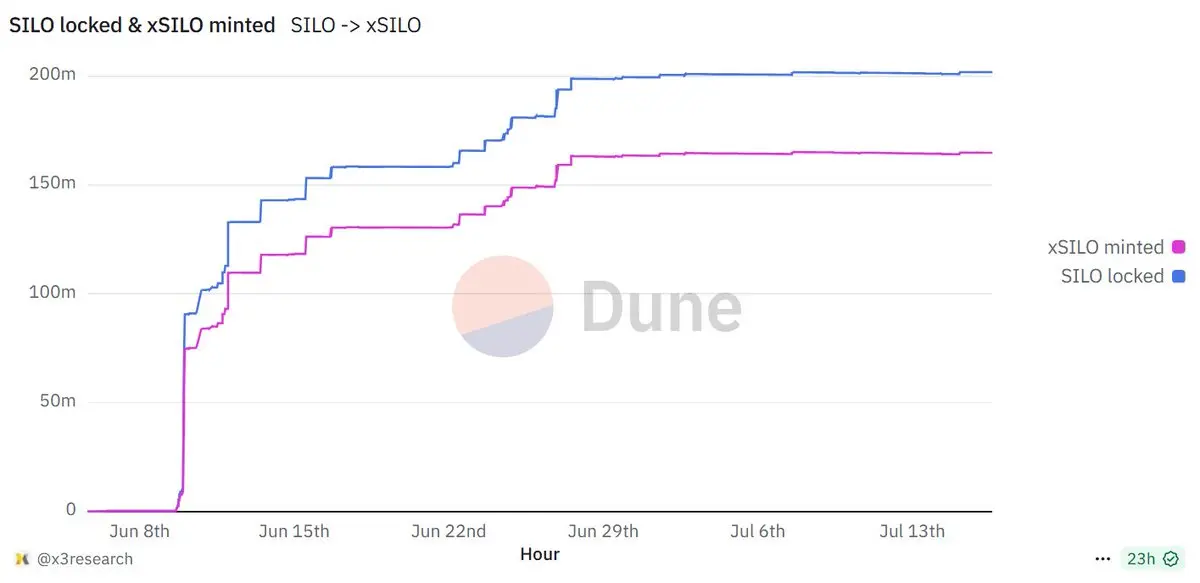

+ 20% of $SILO is locked in xSILO, which significantly reduces sell pressure.

All the metrics point toward healthy growth, both in TVL and unique users, which keep increasing steadily.

From what I see, real DeFi users are leveraging Silo heavily to boost their yields. And Silo

During the hyper DeFi phase on Sonic, they delivered tons of yield opportunities, and now they’re doing the same on Avalanche.

What really surprises me is the Mcap, just $16M, with a $38M FDV. That puts the Mcap/TVL ratio at 0.03, one of the lowest in the space right now.

+ 20% of $SILO is locked in xSILO, which significantly reduces sell pressure.

All the metrics point toward healthy growth, both in TVL and unique users, which keep increasing steadily.

From what I see, real DeFi users are leveraging Silo heavily to boost their yields. And Silo

- Reward

- like

- Comment

- Share

It's strange to drop hard on the short-term ranking while rising hard on the long-term.

- Reward

- like

- Comment

- Share

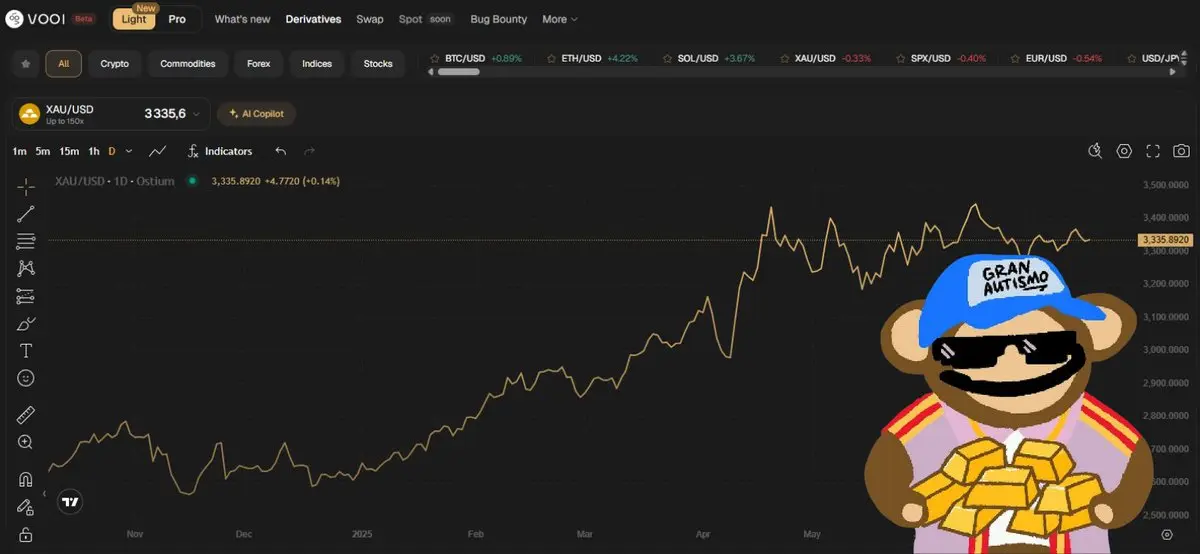

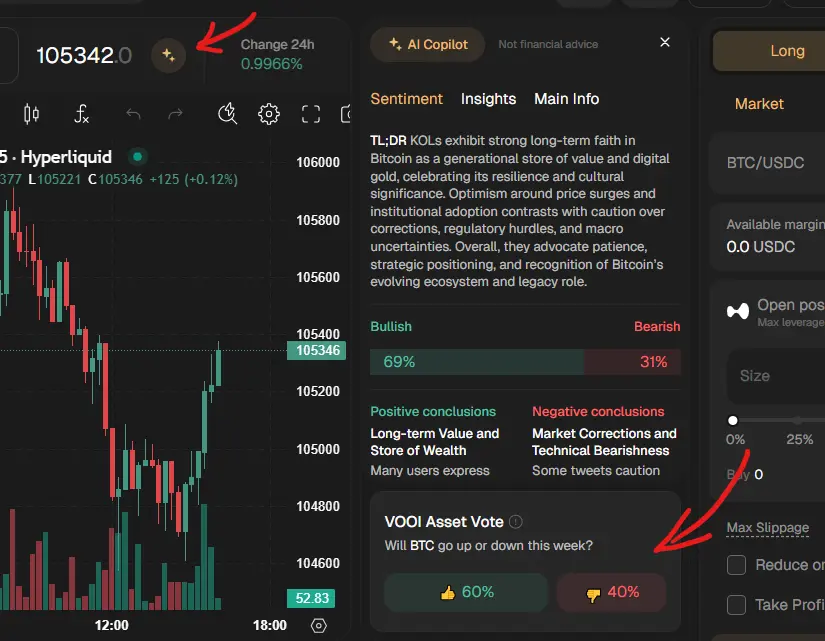

Gold is probably the easiest asset to trade rn, especially given the current global political and economic climate.

When the world is a mess, there are 3 things you have to own: gold, land, and of course, BTC.

Borderless, permissionless, app-stracted, honestly, I’m really enjoying my trading experience on VOOI.

When the world is a mess, there are 3 things you have to own: gold, land, and of course, BTC.

Borderless, permissionless, app-stracted, honestly, I’m really enjoying my trading experience on VOOI.

- Reward

- like

- Comment

- Share

- Reward

- like

- Comment

- Share

- Reward

- like

- Comment

- Share

- Reward

- like

- Comment

- Share

But what will really make the difference is their upcoming AI copilot.

It’s an in-app assistant that gives real-time suggestions based on asset conditions. Can’t wait to see what it does for gold and oil with the current political context.

It’s an in-app assistant that gives real-time suggestions based on asset conditions. Can’t wait to see what it does for gold and oil with the current political context.

APP0.31%

- Reward

- like

- Comment

- Share

Existing LLMs like GPT, Claude, and others have hit their limit, they’ve already scraped all the public web and open data.

What’s left is private, user-permissioned content that lives inside apps and can’t just be scraped like that. This data is far more valuable and higher quality, but it’s protected by IP and must be accessed legitimately.

You’ve probably heard “you are what you eat”, it’s the same for AI: what separates good models from bad ones is the quality of the data they’re trained on.

Future models will rely on trusted, gated data streams flowing from user-focused apps, not outdated

What’s left is private, user-permissioned content that lives inside apps and can’t just be scraped like that. This data is far more valuable and higher quality, but it’s protected by IP and must be accessed legitimately.

You’ve probably heard “you are what you eat”, it’s the same for AI: what separates good models from bad ones is the quality of the data they’re trained on.

Future models will rely on trusted, gated data streams flowing from user-focused apps, not outdated

- Reward

- like

- Comment

- Share

- Reward

- like

- Comment

- Share