TradingKingGaoYuliang

TradingKingGaoYuliang

No content yet

- Reward

- like

- Comment

- Repost

- Share

Bitcoin long order Bots, free copy, fast Arbitrage, add 50% Margin

BTC0.65%

Bitcoin price prediction

Rebound starts

2

2

fall below 100,000

0

0

2 ParticipantsVoting Finished

[The user has shared his/her trading data. Go to the App to view more.]

- Reward

- like

- Comment

- Repost

- Share

Stable Arbitrage

View Original[The user has shared his/her trading data. Go to the App to view more.]

- Reward

- like

- Comment

- Repost

- Share

The short-term shorting reminder from forty minutes ago, opened a short-term shorting Bots, there were already signs of a fall back then, follow to receive timely updates.

BTC0.65%

[The user has shared his/her trading data. Go to the App to view more.]

- Reward

- like

- Comment

- Repost

- Share

short-term shorting

View Original[The user has shared his/her trading data. Go to the App to view more.]

- Reward

- like

- Comment

- Repost

- Share

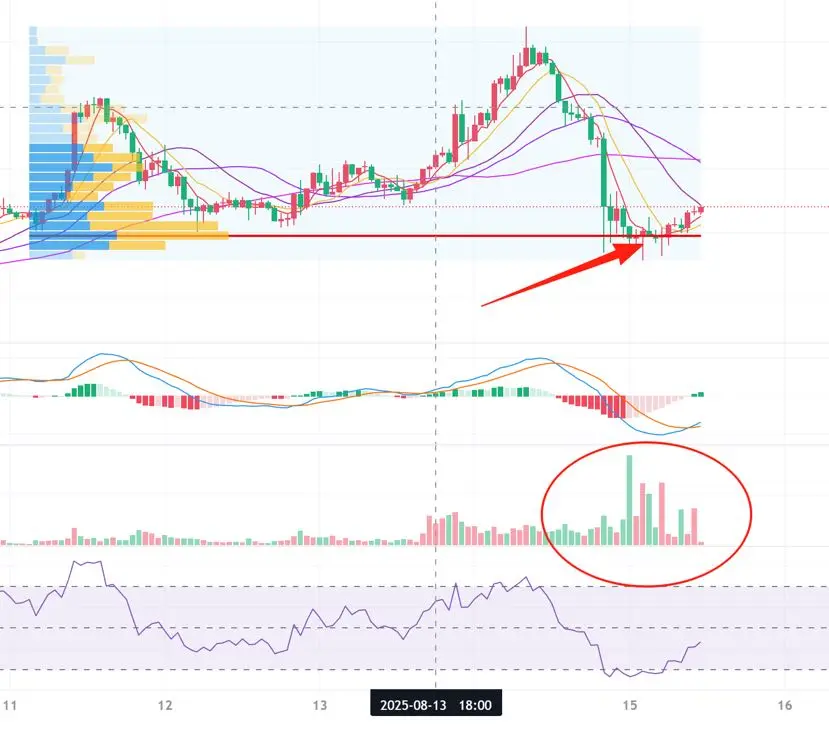

The current downtrend on the 15-minute chart has slowed down, with a decrease in volume and a sideways movement. The MACD shows a bottom divergence, and according to the Dow Theory's 123 rule, if it holds above 115400, one can go long.

BTC0.65%

Bitcoin trend prediction

stop falling and rise, prepare to reverse

8

8

After sideways fluctuations, it continues to fall.

1

1

9 ParticipantsVoting Finished

[The user has shared his/her trading data. Go to the App to view more.]

- Reward

- like

- Comment

- Repost

- Share

Grid arbitrage is very comfortable, Bitcoin is also relatively stable with low risk, medium to long term #BTC ETF持仓破1530亿美元#

BTC0.65%

[The user has shared his/her trading data. Go to the App to view more.]

- Reward

- like

- Comment

- Repost

- Share

The pancake has slightly retraced, pay attention to the support below, if it holds above, you can enter to go long, near the level of 115300 #BTC ETF持仓破1530亿美元# .

BTC0.65%

[The user has shared his/her trading data. Go to the App to view more.]

- Reward

- like

- 1

- Repost

- Share

FengBaobao :

:

CoinShares report shows that Ether-related investment products attracted a staggering $2.87 billion last week, accounting for 77% of the total inflows, setting a new historical record. Since the beginning of this year, the net inflow for Ether funds has reached $11 billion, also a new high. In terms of Assets Under Management ratio, Ether's net inflow this year has reached 29% of AUM, far exceeding Bitcoin's 11.6%. In comparison, while Bitcoin funds recorded only $552 million in net inflows last week, underperforming Ether, they still maintained positive capital momentum. Among other competitive coins, Solana funds attracted $176.5 million; Ripple (XRP) investment products saw inflows of $125.9 million; as for Litecoin (Litecoin) and TON, there were slight outflows of $400,000 and $1 million, respectively.

BTC indeed stopped falling and rebounded as I mentioned earlier. I tell everyone to buy at 114800, now making money #BTC ETF持仓破1530亿美元# .

BTC0.65%

[The user has shared his/her trading data. Go to the App to view more.]

- Reward

- 1

- Comment

- Repost

- Share

Two hours ago, I suggested buying near 114800, it consolidated sideways for about an hour before breaking through. Recently, the flow limit has been quite serious, so follow for continuous sharing of points. Bots can also replicate, ensuring steady arbitrage.

BTC0.65%

[The user has shared his/her trading data. Go to the App to view more.]

- Reward

- like

- Comment

- Repost

- Share

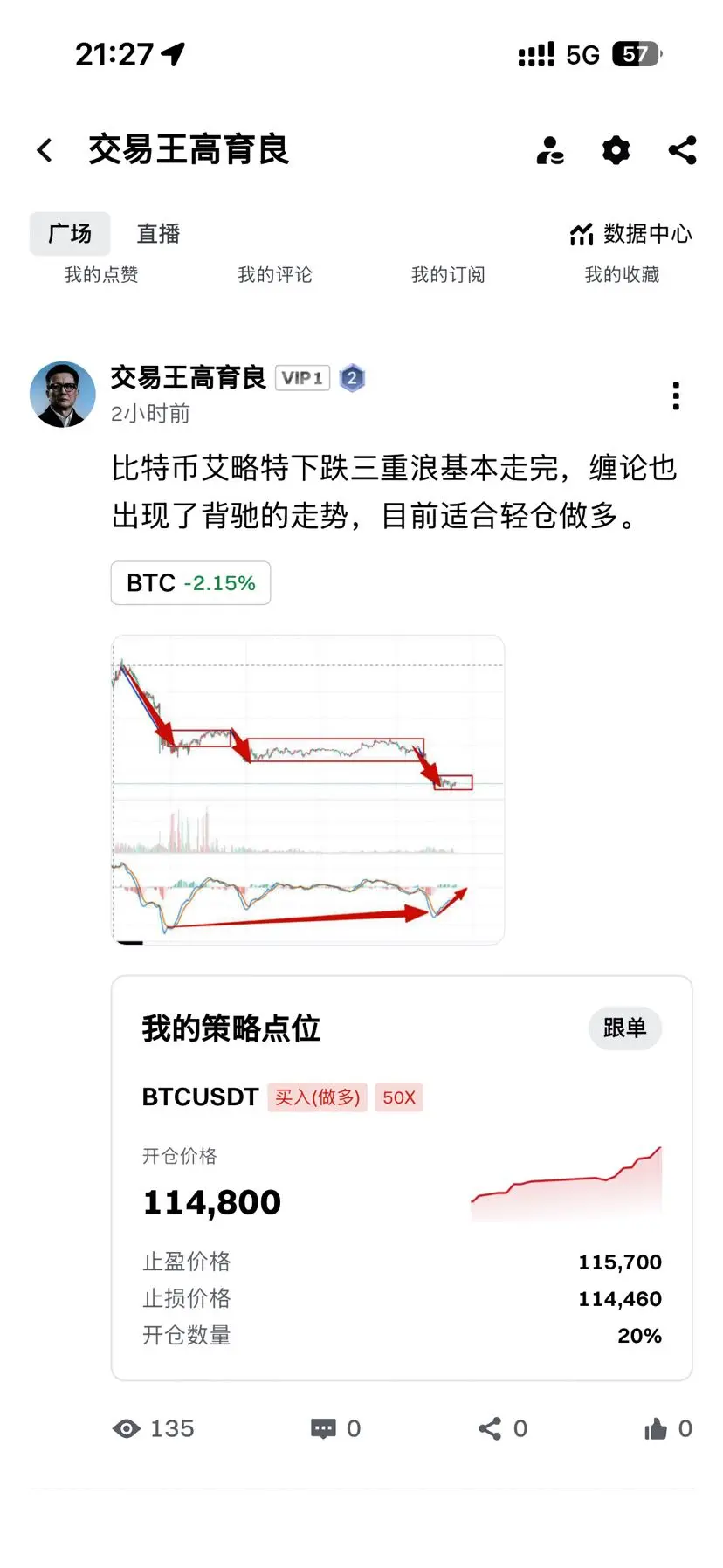

Bitcoin Elliott has completed the three-wave fall, and the Chan theory has also shown a divergence in the trend. Currently, it is suitable to take a Light Position and go long.

BTC0.65%

[The user has shared his/her trading data. Go to the App to view more.]

- Reward

- like

- Comment

- Repost

- Share

Don't rush to buy the dip; it's not too late to enter the market when the fall has extreme lower trade volumes and a bullish belt hold appears.

BTC0.65%

[The user has shared his/her trading data. Go to the App to view more.]

- Reward

- like

- Comment

- Repost

- Share

When the price reaches 113800, the Bots will automatically start, ensuring stable arbitrage.

View Original[The user has shared his/her trading data. Go to the App to view more.]

- Reward

- like

- Comment

- Repost

- Share

Bitcoin has woken up and dropped significantly. Currently, there is a rebound demand due to a bullish divergence, but pay attention to the 117860 resistance level. If it fails to break through during two rebounds, there may be a dip to seek support. It is advisable to stay on the sidelines for now, and a breakthrough of 117860 could prompt a small position to go long.

BTC0.65%

Bitcoin price trend prediction

Continue to dip to find support

3

3

Breakout or Sideways movement

1

1

4 ParticipantsVoting Finished

- Reward

- like

- Comment

- Repost

- Share

Predict the low point one hour in advance, remind everyone to buy at 118000, just hit the low point of 118007, the error is less than 0.01%, accurate prediction. I don't know how many frens saw it, but it's okay if you didn't, just follow for 24-hour online analysis.

BTC0.65%

[The user has shared his/her trading data. Go to the App to view more.]

- Reward

- like

- Comment

- Repost

- Share

The Bitcoin trend is roughly as expected, with a short-term 15-minute top divergence phenomenon. A pullback is anticipated to the range of 117950-118000, where a small position can be taken to go long.

BTC0.65%

[The user has shared his/her trading data. Go to the App to view more.]

- Reward

- like

- Comment

- Repost

- Share

The two resistance levels of 117750 and 118100 mentioned yesterday have been validated, and after touching the resistance level, a pullback occurred. Currently, it still looks like a weak recovery, and the Trading Volume is not sufficient. Those who are in profit can reduce position and do day trading to prevent a high pullback.

BTC0.65%

Today's Bitcoin Trend Prediction

Rise to 119000

3

3

Fluctuating around 118,000

2

2

5 ParticipantsVoting Finished

[The user has shared his/her trading data. Go to the App to view more.]

- Reward

- 1

- Comment

- Repost

- Share

The market looks weak for correction, with little trading volume over the weekend. The resistance level at the 15-minute level is 117750, and at the hourly level, it is 118100. If it holds above the resistance level, one can take a small position to go long. The MACD divergence is evident, so there might be a minor trend at midnight.

BTC0.65%

Bitcoin price prediction

Breakthrough 118000

4

4

Return to 117000 oscillation

3

3

7 ParticipantsVoting Finished

- Reward

- like

- 2

- Repost

- Share

GetRich,BeBeautiful,AndHave :

:

Waited a whole day to post.View More

After multiple tops divergence of Ethereum, the market makers coordinated with the PPI news to dump, clearing out profitable positions. A risk warning was given after the initial top divergence a few days ago, but the buying strength has been much stronger than expected. Currently, the upward trend is still intact, and the trading volume is performing well, but there are too many loss-making positions at the top. Pay attention to the key resistance level of 4695-4715.

ETH4.21%

Can we break through 4700 today?

can

13

13

cannot

6

6

19 ParticipantsVoting Finished

- Reward

- like

- Comment

- Repost

- Share

The Bitcoin 117900 position has very strong support, it is a dense trading area, and the trading volume has reached a new high. The trading volume in the previous four to five days is not as much as this half day, and it has also formed a rounded bottom pattern. It can basically be concluded that 117900 is the recent bottom, and long orders are still firmly held.

BTC0.65%

Bitcoin trend prediction

Bottom formation, All in enter a position

2

2

wait and see

0

0

2 ParticipantsVoting Finished

[The user has shared his/her trading data. Go to the App to view more.]

- Reward

- like

- Comment

- Repost

- Share