Liquidity Wars 3.0 where Bribes Become Markets

I believe we will see yield wars once again. If you’ve been around DeFi long enough, you know that TVL is a vanity metric until it isn’t.

Because in a hyper-competitive, modular world of AMMs, perps, and lending protocols, the only thing that really matters is who controls liquidity routing. Not who owns the protocol. Not even who emits the most rewards.

But who convinces liquidity providers (LPs) deposit and make sure that TVL is sticky.

And that’s where the bribe economy begins.

What used to be informal vote-buying (Curve wars, Convex, etc.) has now professionalized into full-blown liquidity coordination marketplaces, complete with order books, dashboards, incentive routing layers, and in some cases, gamified participation mechanics.

It’s becoming one of the most strategically important layers in the entire DeFi stack.

What’s Changed: From Emissions to Meta-Incentives

Back in 2021–2022, protocols would bootstrap liquidity the old way:

- Deploy a pool

- Emit a token

- Hope mercenary LPs stuck around after the yield dropped

But this model is fundamentally flawed, it’s reactive. Every new protocol competes against an invisible cost: the opportunity cost of existing capital flows.

I. The Origin of Yield Wars: Curve and the Rise of Vote Markets

The concept of Yield Wars started becoming tangible with the Curve Wars, beginning in 2021.

Curve Finance’s Unique Design

Curve introduced vote-escrowed (ve) tokenomics, where users could lock $CRV (Curve’s native token) for up to 4 years in exchange for veCRV, which granted:

- Boosted rewards on Curve pools

- Governance power to vote on gauge weights (which pools receive emissions)

This created a meta-game around emissions:

- Protocols wanted liquidity on Curve.

- The only way to get it was to attract votes to their pool.

- So they started bribing veCRV holders to vote in their favor.

Then came Convex Finance

- Convex abstracted away veCRV locking and aggregated voting power from users.

- It became the “Curve Kingmaker,” with enormous influence over where $CRV emissions went.

- Projects started bribing Convex/veCRV holders via platforms like Votium.

Lesson #1: He who controls the gauge controls liquidity.

II. Meta-Incentives and Bribe Markets

The First Bribe Economy

What began as a manual effort to influence emissions evolved into a full-blown market where:

- Votium became the OTC bribing desk for $CRV emissions.

- Redacted Cartel, Warden, and Hidden Hand emerged to expand this to other protocols like Balancer, Frax, and more.

- Protocols were no longer just paying for emissions, they were strategically allocating incentives to optimize capital efficiency.

The Expansion Beyond Curve

- Balancer adopted vote-escrow mechanics via $veBAL.

- Frax, @TokemakXYZ, and others integrated similar systems.

- Incentive routing platforms like Aura Finance and Llama Airforce further layered on complexity, turning emissions into a capital coordination game.

Lesson #2: Yield is no longer about APY, it’s about programmable meta-incentives.

III. How Yield Wars Are Fought

Here’s how protocols compete in this meta-game:

- Liquidity Aggregation: Aggregate influence through Convex-like wrappers (e.g., @AuraFinance for Balancer).

- Bribe Campaigns: Budget for ongoing vote buying to attract emissions where needed.

- Game Theory & Tokenomics: Lock tokens to create long-term alignment (e.g., ve-models).

- Community Incentivization: Gamify votes through NFTs, raffles, or bonus airdrop.

Today, protocols like @turtleclubhouse and @roycoprotocoldirects that liquidity: instead of emitting blindly, they auction off incentives to LPs based on demand signals.

In essence: “You bring liquidity, we’ll route incentives where they matter most.”

This unlocks a second-order effect: Protocols no longer have to brute-force liquidity, instead they coordinate it.

Turtle Club

Quietly one of the most effective bribe markets no one’s talking about. Their pools are often embedded in partnerships and have TVL exceeding $580M, with dual-token emissions, weighted bribes, and a surprisingly sticky LP base.

Their model emphasizes fair value redistribution, meaning emissions are steered by vote, and by real-time capital velocity metrics.

It’s a smarter flywheel: LPs get rewarded relative to their capital’s effectiveness, not just size. For once, efficiency is incentivized.

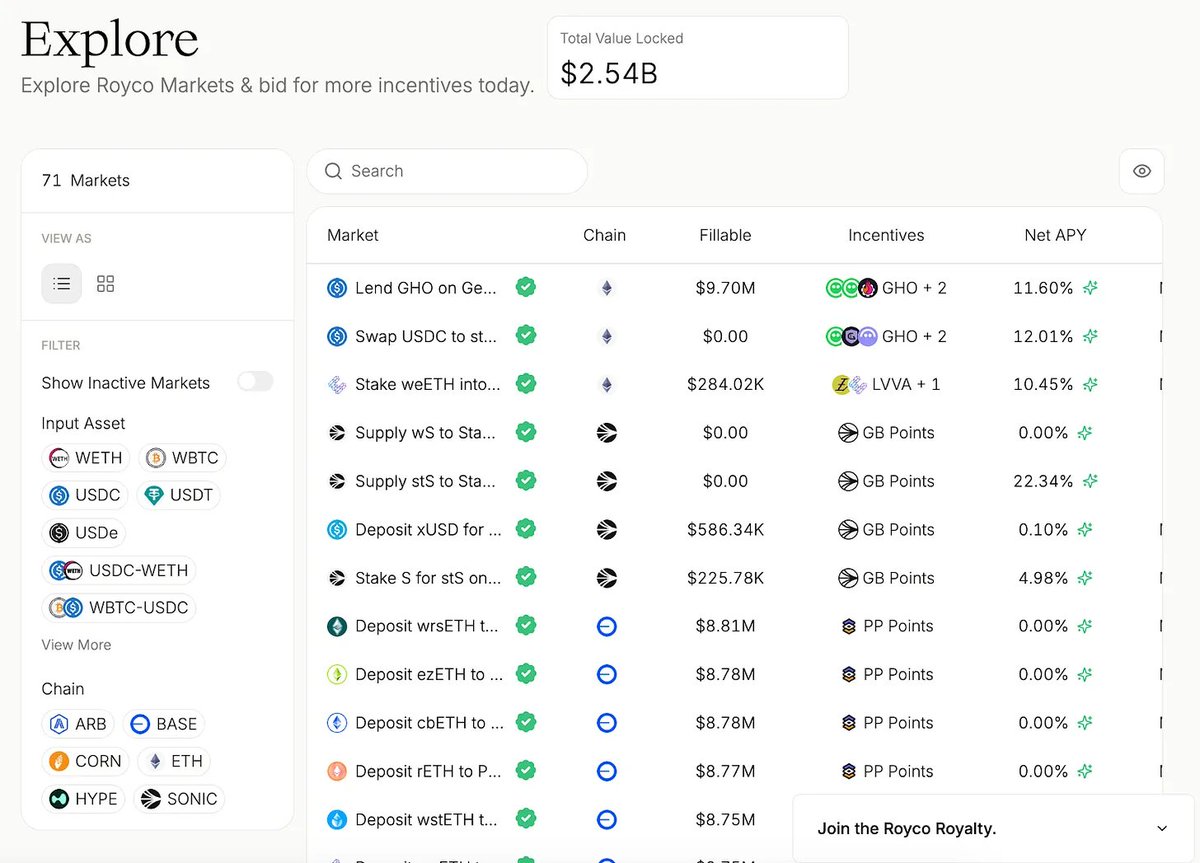

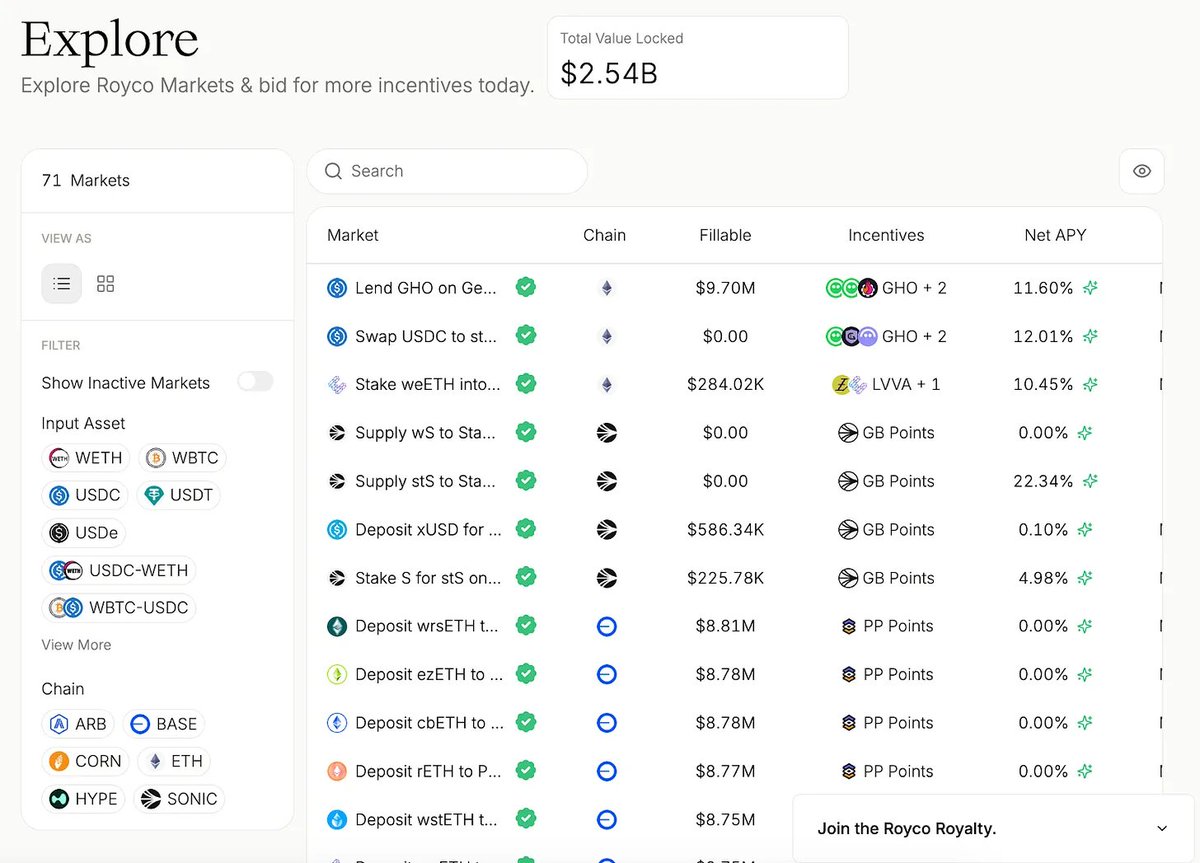

Royco

In a single month, it surged over $2.6 billion in TVL, a wild 267,000% month-over-month growth.

While some of that is “points-fueled” capital, what matters is the infrastructure behind it:

- Royco is the order book for liquidity preferences.

- Protocols can’t just dump rewards and hope. They post requests, then LPs decides to put in capital, then the coordination becomes a marketplace.

Here’s what makes this narrative more than just a yield game:

- These marketplaces are becoming the meta-governance layer of DeFi.

- @HiddenHand Fialready routes $35M+ in cumulative bribes across major protocols like @VelodromeFi and @Balancer.

- Royco and Turtle Club are now shaping where emissions are effective.

The Mechanics of Liquidity Coordination Markets

- Bribes as Market Signals

- Projects like Turtle Club allow LPs to see where incentives are flowing, make decisions based on real-time metrics, and be rewarded based on capital efficiency rather than just capital size.

- Requests-for-Liquidity (RfL) as Order Books

- Projects like Royco allow protocols to list liquidity needs like orders on a marketplace, LPs fill them based on expected return.

- This becomes a two-sided coordination game, not a one-way bribe.

If you decide where the liquidity goes, you influence who survives the next market cycle.

Disclaimer:

- This article is reprinted from [arndxt]. All copyrights belong to the original author [@arndxt_xo]. If there are objections to this reprint, please contact the Gate Learn team, and they will handle it promptly.

- Liability Disclaimer: The views and opinions expressed in this article are solely those of the author and do not constitute any investment advice.

- Translations of the article into other languages are done by the Gate Learn team. Unless mentioned, copying, distributing, or plagiarizing the translated articles is prohibited.

Liquidity Wars 3.0 where Bribes Become Markets

What’s Changed: From Emissions to Meta-Incentives

Turtle Club

Royco

The Mechanics of Liquidity Coordination Markets

I believe we will see yield wars once again. If you’ve been around DeFi long enough, you know that TVL is a vanity metric until it isn’t.

Because in a hyper-competitive, modular world of AMMs, perps, and lending protocols, the only thing that really matters is who controls liquidity routing. Not who owns the protocol. Not even who emits the most rewards.

But who convinces liquidity providers (LPs) deposit and make sure that TVL is sticky.

And that’s where the bribe economy begins.

What used to be informal vote-buying (Curve wars, Convex, etc.) has now professionalized into full-blown liquidity coordination marketplaces, complete with order books, dashboards, incentive routing layers, and in some cases, gamified participation mechanics.

It’s becoming one of the most strategically important layers in the entire DeFi stack.

What’s Changed: From Emissions to Meta-Incentives

Back in 2021–2022, protocols would bootstrap liquidity the old way:

- Deploy a pool

- Emit a token

- Hope mercenary LPs stuck around after the yield dropped

But this model is fundamentally flawed, it’s reactive. Every new protocol competes against an invisible cost: the opportunity cost of existing capital flows.

I. The Origin of Yield Wars: Curve and the Rise of Vote Markets

The concept of Yield Wars started becoming tangible with the Curve Wars, beginning in 2021.

Curve Finance’s Unique Design

Curve introduced vote-escrowed (ve) tokenomics, where users could lock $CRV (Curve’s native token) for up to 4 years in exchange for veCRV, which granted:

- Boosted rewards on Curve pools

- Governance power to vote on gauge weights (which pools receive emissions)

This created a meta-game around emissions:

- Protocols wanted liquidity on Curve.

- The only way to get it was to attract votes to their pool.

- So they started bribing veCRV holders to vote in their favor.

Then came Convex Finance

- Convex abstracted away veCRV locking and aggregated voting power from users.

- It became the “Curve Kingmaker,” with enormous influence over where $CRV emissions went.

- Projects started bribing Convex/veCRV holders via platforms like Votium.

Lesson #1: He who controls the gauge controls liquidity.

II. Meta-Incentives and Bribe Markets

The First Bribe Economy

What began as a manual effort to influence emissions evolved into a full-blown market where:

- Votium became the OTC bribing desk for $CRV emissions.

- Redacted Cartel, Warden, and Hidden Hand emerged to expand this to other protocols like Balancer, Frax, and more.

- Protocols were no longer just paying for emissions, they were strategically allocating incentives to optimize capital efficiency.

The Expansion Beyond Curve

- Balancer adopted vote-escrow mechanics via $veBAL.

- Frax, @TokemakXYZ, and others integrated similar systems.

- Incentive routing platforms like Aura Finance and Llama Airforce further layered on complexity, turning emissions into a capital coordination game.

Lesson #2: Yield is no longer about APY, it’s about programmable meta-incentives.

III. How Yield Wars Are Fought

Here’s how protocols compete in this meta-game:

- Liquidity Aggregation: Aggregate influence through Convex-like wrappers (e.g., @AuraFinance for Balancer).

- Bribe Campaigns: Budget for ongoing vote buying to attract emissions where needed.

- Game Theory & Tokenomics: Lock tokens to create long-term alignment (e.g., ve-models).

- Community Incentivization: Gamify votes through NFTs, raffles, or bonus airdrop.

Today, protocols like @turtleclubhouse and @roycoprotocoldirects that liquidity: instead of emitting blindly, they auction off incentives to LPs based on demand signals.

In essence: “You bring liquidity, we’ll route incentives where they matter most.”

This unlocks a second-order effect: Protocols no longer have to brute-force liquidity, instead they coordinate it.

Turtle Club

Quietly one of the most effective bribe markets no one’s talking about. Their pools are often embedded in partnerships and have TVL exceeding $580M, with dual-token emissions, weighted bribes, and a surprisingly sticky LP base.

Their model emphasizes fair value redistribution, meaning emissions are steered by vote, and by real-time capital velocity metrics.

It’s a smarter flywheel: LPs get rewarded relative to their capital’s effectiveness, not just size. For once, efficiency is incentivized.

Royco

In a single month, it surged over $2.6 billion in TVL, a wild 267,000% month-over-month growth.

While some of that is “points-fueled” capital, what matters is the infrastructure behind it:

- Royco is the order book for liquidity preferences.

- Protocols can’t just dump rewards and hope. They post requests, then LPs decides to put in capital, then the coordination becomes a marketplace.

Here’s what makes this narrative more than just a yield game:

- These marketplaces are becoming the meta-governance layer of DeFi.

- @HiddenHand Fialready routes $35M+ in cumulative bribes across major protocols like @VelodromeFi and @Balancer.

- Royco and Turtle Club are now shaping where emissions are effective.

The Mechanics of Liquidity Coordination Markets

- Bribes as Market Signals

- Projects like Turtle Club allow LPs to see where incentives are flowing, make decisions based on real-time metrics, and be rewarded based on capital efficiency rather than just capital size.

- Requests-for-Liquidity (RfL) as Order Books

- Projects like Royco allow protocols to list liquidity needs like orders on a marketplace, LPs fill them based on expected return.

- This becomes a two-sided coordination game, not a one-way bribe.

If you decide where the liquidity goes, you influence who survives the next market cycle.

Disclaimer:

- This article is reprinted from [arndxt]. All copyrights belong to the original author [@arndxt_xo]. If there are objections to this reprint, please contact the Gate Learn team, and they will handle it promptly.

- Liability Disclaimer: The views and opinions expressed in this article are solely those of the author and do not constitute any investment advice.

- Translations of the article into other languages are done by the Gate Learn team. Unless mentioned, copying, distributing, or plagiarizing the translated articles is prohibited.