- Topic

11k Popularity

16k Popularity

13k Popularity

6k Popularity

2k Popularity

- Pin

- Gate July 2025 Transparency Report:

Accelerating Leadership in the Global Crypto Landscape!

#GateTransparencyReport# - 📢 Gate Square Exclusive: #PUBLIC Creative Contest# Is Now Live!

Join Gate Launchpool Round 297 — PublicAI (PUBLIC) and share your post on Gate Square for a chance to win from a 4,000 $PUBLIC prize pool

🎨 Event Period

Aug 18, 2025, 10:00 – Aug 22, 2025, 16:00 (UTC)

📌 How to Participate

Post original content on Gate Square related to PublicAI (PUBLIC) or the ongoing Launchpool event

Content must be at least 100 words (analysis, tutorials, creative graphics, reviews, etc.)

Add hashtag: #PUBLIC Creative Contest#

Include screenshots of your Launchpool participation (e.g., staking record, reward - 🎉 Hey Gate Square friends! Non-stop perks and endless excitement—our hottest posting reward events are ongoing now! The more you post, the more you win. Don’t miss your exclusive goodies! 🚀

🆘 #Gate 2025 Semi-Year Community Gala# | Square Content Creator TOP 10

Only 1 day left! Your favorite creator is one vote away from TOP 10. Interact on Square to earn Votes—boost them and enter the prize draw. Prizes: iPhone 16 Pro Max, Golden Bull sculpture, Futures Vouchers!

Details 👉 https://www.gate.com/activities/community-vote

1️⃣ #Show My Alpha Points# | Share your Alpha points & gains

Post your - 💙 Gate Square #Gate Blue Challenge# 💙

Show your limitless creativity with Gate Blue!

📅 Event Period

August 11 – 20, 2025

🎯 How to Participate

1. Post your original creation (image / video / hand-drawn art / digital work, etc.) on Gate Square, incorporating Gate’s brand blue or the Gate logo.

2. Include the hashtag #Gate Blue Challenge# in your post title or content.

3. Add a short blessing or message for Gate in your content (e.g., “Wishing Gate Exchange continued success — may the blue shine forever!”).

4. Submissions must be original and comply with community guidelines. Plagiarism or re

Is the advance-decline ratio a sign of an imminent peak? | Market Emotions | Moneyクリ Monex Securities' investment information and media that helps with money.

The Tokyo Stock Exchange Prime Market's 25-day advance-decline ratio shows strong overbought sentiment

The Tokyo stock market this week (week of August 11) is likely to show a steady performance, although there are concerns about short-term overheating. In the US market, sentiment is improving due to rising expectations for future interest rate cuts. While interest rate cuts in the US could lead to a weaker dollar and stronger yen, which would suppress the upside for Japanese stocks, the expectation of capital inflows from foreign investors will support a rotation into major stocks.

On the other hand, the Tokyo Stock Exchange Prime Market's advance-decline ratio (25-day) was at 146.85% as of August 8, indicating a strong sense of overheating, and has risen to its highest level since 2024. The advance-decline ratio is generally viewed as overbought (ceiling zone) when it exceeds 120%, neutral at 100%, and oversold (bottom zone) when it is below 70%.

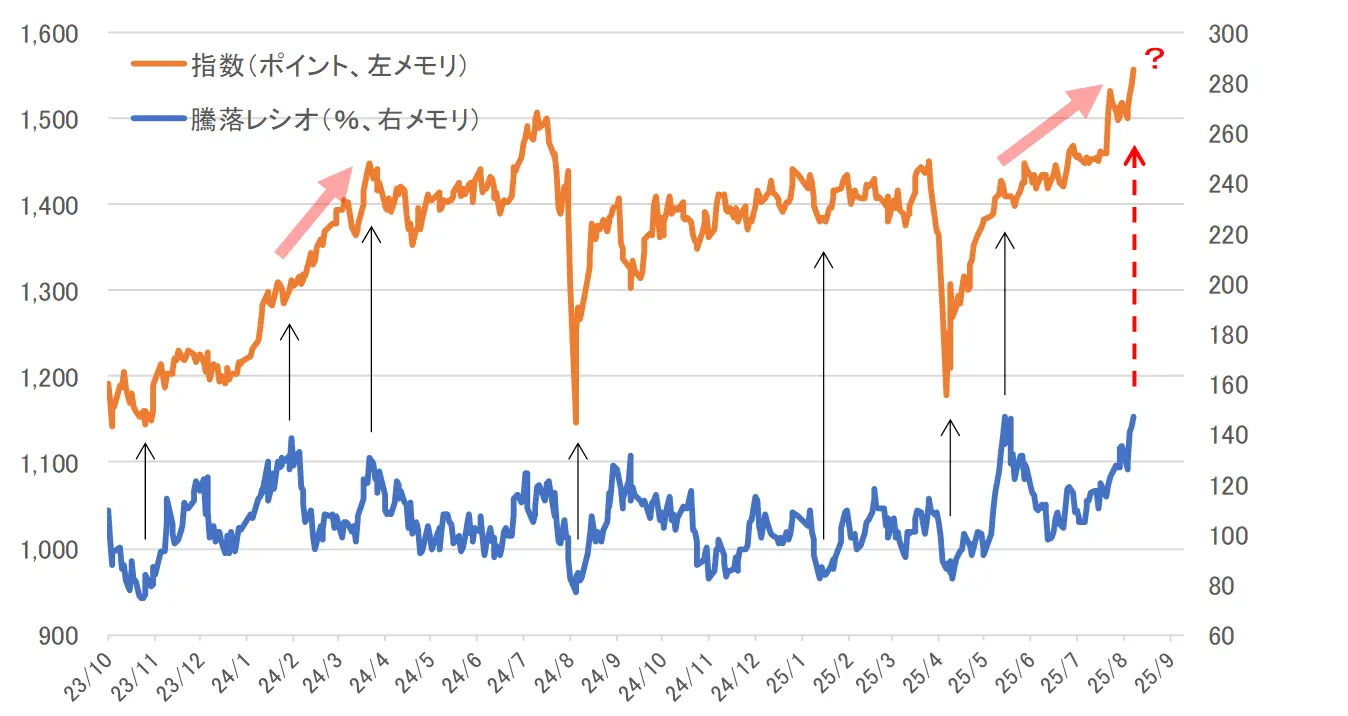

[Figure 1] Prime Index and Advance-Decline Ratio (25 Days) Source: Created by DZH Financial Research from QUICK Astra Manager

Source: Created by DZH Financial Research from QUICK Astra Manager

The ceiling of the advance-decline ratio does not necessarily match the ceiling of the index.

The advance-decline ratio functions effectively in the bottom zone, but a more nuanced perspective is required in the top zone. Looking at Chart 1, it can be confirmed that the lows of the advance-decline ratio and the index generally match. However, the highs of the advance-decline ratio do not necessarily correspond with the highs of the index. For example, there was a rise of over 130% from January 25 to February 5, 2024, but the index actually reached its peak two months later, on March 22. Additionally, it rose to 146.54% on May 15, 2025, but the index continued to rise without significant corrections thereafter.

Just because the advance-decline ratio has risen to an overbought level, selling your holdings may lead to missing out on profits. Instead of solely relying on numerical values to determine overbought conditions, it is better to use it as one of the confirmation tools to verify that the upward trend of the index is still continuing.

Based on the above, let’s take a slightly more complex view in situations where the advance-decline ratio exceeds 120%. In the case of 2024, even after rising to the 130% range, the index continued to rise for about two months, but there was a moment when the advance-decline ratio again rose to the 130% range near where the index was setting a temporary peak. If the level of 140% on May 15, 2025, was confirmation material for the continuation of the upward trend, then the level of 140% on August 8, which rose to the same level as then, could be a warning sign that the index's peak is near.

Japanese stocks may be seen as temporarily pausing their rise.

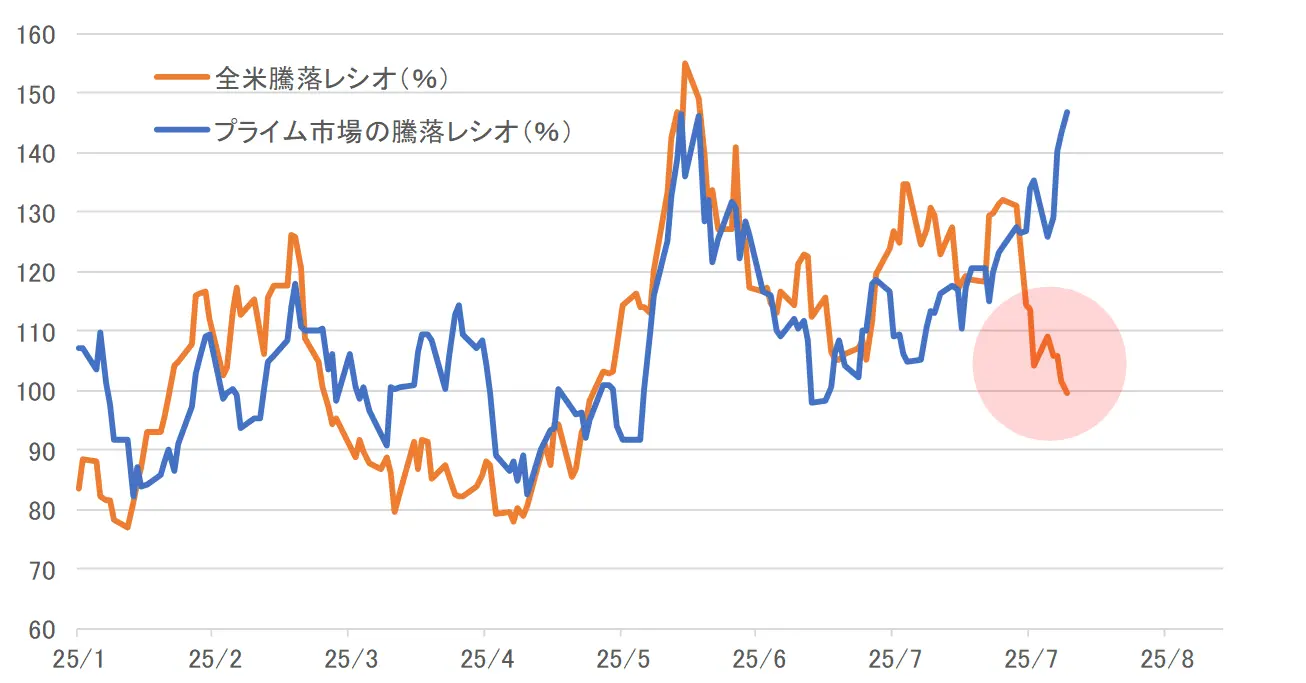

[Chart 2] Japan-U.S. Rising and Falling Ratio (25 Days) Source: Created by DZH Financial Research from QUICK Astra Manager

Chart 2 compares the movement of the advance-decline ratio (25-day) covering the entire United States and the advance-decline ratio (25-day) of Japan's prime market for the year 2025 only. Although the number and timing of holidays in Japan and the United States differ, the dates have been adjusted for clarity in comparison.

Source: Created by DZH Financial Research from QUICK Astra Manager

Chart 2 compares the movement of the advance-decline ratio (25-day) covering the entire United States and the advance-decline ratio (25-day) of Japan's prime market for the year 2025 only. Although the number and timing of holidays in Japan and the United States differ, the dates have been adjusted for clarity in comparison.

Looking at this, it seems that the 140% range in May was linked to the upward trend of the US market. However, the current US market is in a high index trend while the advance-decline ratio has been on a downward trend since peaking on July 25. If this suggests an imminent corrective reversal of the major US indices, it may indicate a temporary pause in the rise of Japanese stocks as well.