Circle Merilis Whitepaper 'Jaringan Pembayaran Stablecoin'

Pada awal 2025, “Dolar Digital di Value Internet—Laporan Ekonomi Pasar USDC 2025“menguraikan tiga narasi untuk USDC: (1) upgrade keuangan internet; (2) menghubungkan jaringan melalui USDC; dan (3) memperluas kasus penggunaan USDC melalui efek jaringan.

Bagi Circle, yang kini memiliki pangsa pasar sebesar 26% di sektor stablecoin, dua narasi pertama tidak lagi mencukupi. Jaringan Pembayaran Circle yang baru diluncurkan mewakili langkahnya, sebagai penerbit stablecoin yang patuh secara global, untuk menangkap nilai USDC—dan stablecoin secara lebih luas—dalam jaringan global.

Dolar AS dan internet keduanya secara inheren memiliki efek jaringan yang kuat. Baik di dunia fisik maupun internet, dolar berfungsi sebagai mata uang dengan efek jaringan yang kuat. Teknologi blockchain memberikan USDC dengan fungsionalitas yang lebih besar dan potensi aplikasi baru di luar tradisional dolar, sambil masih mengandalkan internet tradisional untuk implementasi di dunia nyata.

Circle sedang membangun platform teknologi terbuka yang berpusat di sekitar USDC, memanfaatkan dominasi dolar AS dan adopsi luas untuk memberikan efek jaringan dan utilitas bagi layanan keuangan, dengan memanfaatkan skala, kecepatan, dan keunggulan biaya dari internet.

Jaringan Pembayaran Lingkaran adalah infrastruktur yang patuh dari Circle yang menggabungkan lembaga keuangan yang menawarkan layanan USDC menjadi kerangka kerja yang terpadu, mulus, dan dapat diprogram untuk mengkoordinasikan pembayaran global yang melibatkan mata uang fiat, USDC, dan stablecoin pembayaran lainnya.

Sebagai hasilnya, mata uang fiat tidak akan lagi perlu beredar melalui sistem SWIFT yang ketinggalan zaman, dan dolar digital berbasis blockchain akan menjadi rel penyelesaian baru.

Pada intinya, jaringan pembayaran berbasis penyelesaian blockchain Circle berfungsi sebagai undangan pemakaman untuk saluran tradisional seperti SWIFT, VISA, dan Mastercard—membawa kita ke dalam transformasi monumental, sebanding dengan pergeseran dari surat pos ke email, dari kereta kuda ke trem listrik, dan dari kabel telegraf transatlantik ke transmisi nilai internet blockchain.

Titik penting lainnya adalah posisi Circle dalam Jaringan Pembayaran Circle: lapisan protokol baru yang dibangun di atas sistem penyelesaian internet terbuka dan komprehensif, dengan stablecoin sebagai inti. Posisi ini memungkinkan jaringan ini kompatibel dengan berbagai blockchain lapisan penyelesaian, daripada terperangkap dalam pertempuran untuk dominasi infrastruktur keuangan di antara rantai publik.

Dr. Xiao Feng dari HashKey, dimulai dari inti keuangan, mendefinisikan blockchain publik sebagai infrastruktur keuangan generasi berikutnya—bukan sekadar peningkatan inkremental terhadap sistem yang ada, tetapi inovasi yang mengganggu di sektor perdagangan, kliring, dan penyelesaian, menciptakan paradigma keuangan baru.

Tidak terasa, apa yang Circle ingin bangun adalah jaringan berbasis blockchain terbuka yang sudah menunjukkan garis-garis awal jaringan mirip VISA. Kita mungkin menemukan petunjuk tentang evolusi masa depannya dengan melihat sejarah pengembangan VISA. Hal ini berbeda secara tajam dengan jaringan yang relatif tertutup dari Ripple & RippleNetdanStripe & Jembatan.

Pada bulan Oktober 2023, sambil memberikan pembayaran Web3saat berbicara di Ant Group, saya sudah merenungkan apakah memasukkan aset fiat ke dalam blockchain dan penyelesaiannya melalui stablecoin akan menjadi solusi yang lebih baik. Jelas, setahun setengah kemudian, Circle telah memberikan jawaban yang jelas dan kasus penggunaan yang kuat.

Oleh karena itu, artikel ini mengompilasi dan menerjemahkan Circle's Circle Payments Network Whitepaper, mengeksplorasi prinsip desainnya, kasus penggunaan dunia nyata, potensi aplikasi masa depan dan peluang pertumbuhan, serta model tata kelolanya, yang menyerupai jaringan VISA.

1. Gambaran Umum Whitepaper

Stablecoin telah lama dianggap memiliki potensi untuk menjadi dasar pembayaran dan aliran modal di internet. Namun, sampai baru-baru ini, stablecoin—sebagai uang digital—utamanya digunakan dalam pasar aset digital global dan sektor keuangan terdesentralisasi (DeFi).

Dengan diluncurkannya Jaringan Pembayaran Circle (CPN), Circle mendorong stablecoin ke tahap yang lebih lanjut, membuka potensi mereka untuk meningkatkan sistem pembayaran global—mirip dengan bagaimana masa inovasi internet di masa lalu mengubah industri seperti media, perdagangan, perangkat lunak, dan komunikasi. Perubahan besar ini sangat meningkatkan pengalaman pelanggan, mengurangi biaya, meningkatkan kecepatan, dan memacu pertumbuhan ekonomi global bagi individu dan bisnis.

Untuk mewujudkan potensi ini, Jaringan Pembayaran Circle (CPN) berfungsi sebagai infrastruktur yang dirancang untuk mengatasi banyak hambatan yang sejauh ini membatasi adopsi stablecoin dalam pembayaran mainstream. Hambatan-hambatan ini termasuk hambatan akses, persyaratan kepatuhan yang tidak jelas, kompleksitas teknis, dan kekhawatiran tentang penyimpanan aman uang digital.

Jaringan Pembayaran Lingkaran (CPN) menyatukan lembaga keuangan di bawah kerangka yang patuh, mulus, dan dapat diprogram untuk mengkoordinasikan pembayaran global yang melibatkan mata uang fiat, USDC, dan stablecoin pembayaran lainnya.

Pelanggan korporat dan individu dari lembaga keuangan ini dapat mengakses layanan pembayaran yang lebih cepat dan lebih hemat biaya dibandingkan dengan sistem tradisional, yang sering dibatasi oleh jaringan yang terfragmentasi atau ekosistem tertutup. Secara kritis, Jaringan Pembayaran Circle (CPN) membentuk dasar bagi seluruh ekosistem sebagai infrastruktur, menghilangkan sebagian besar kompleksitas teknis dan hambatan operasional yang sejauh ini menghambat adopsi stablecoin utama, seperti kebutuhan bagi bisnis untuk mengelola sendiri stablecoin. Jaringan Pembayaran Circle (CPN) juga membuka jalan untuk terobosan dalam uang yang dapat diprogram, membuka kasus penggunaan baru untuk uang dalam pertukaran nilai global.

Whitepaper ini menguraikan prinsip-prinsip desain Jaringan Pembayaran Circle (CPN), menjelaskan kasus penggunaan awal dan jangka pendeknya, serta menyajikan potensi aplikasi dan peluang pertumbuhan di masa depan. Tujuannya adalah membantu lembaga keuangan, perusahaan pembayaran, pengembang aplikasi, inovator, dan pemangku kepentingan lain memahami peran mereka dalam membangun dan memanfaatkan Jaringan Pembayaran Circle (CPN)—dan bagaimana jaringan tersebut dapat memberdayakan mereka untuk berinovasi dan memberikan manfaat stablecoin kepada pelanggan mereka.

2. Pengenalan

2.1 Kelemahan dalam Sistem Pembayaran Keuangan Global

Ekonomi global saat ini lebih terhubung daripada sebelumnya, namun tidak seperti sektor ekonomi lainnya, infrastruktur yang mendukung pergerakan modal masih sangat bergantung pada kerangka kerja yang dikembangkan sebelum era internet.

Di masa lalu, tidak mungkin menawarkan sebuah “Protokol Uang” yang mampu mentransfer nilai dalam bentuk digital sepenuhnya asli melalui internet.

Sistem seperti U.S. Automated Clearing House (ACH) dan protokol serupa lainnya menjadi bagian inti dari lanskap pembayaran global yang terfragmentasi setelah muncul pada awal tahun 1970-an. Meskipun perkembangan terkini seperti Single Euro Payments Area (SEPA) di Eurozone, PIX di Brasil, dan Unified Payments Interface (UPI) di India telah meningkatkan kecepatan transaksi domestik, namun masih kurang memiliki standar interoperabilitas global dan skala global. Mereka juga gagal memanfaatkan keterbukaan dan skalabilitas uang yang dapat diprogram yang dibangun di jaringan blockchain terbuka.

Perusahaan dan individu di seluruh dunia menanggung biaya yang besar karena mengandalkan infrastruktur pembayaran tradisional ini. Menurut laporan McKinsey tentang "Pembayaran Global pada Tahun 2024", industri pembayaran global menghasilkan lebih dari $2,4 triliun dalam pendapatan tahunan, sebagian besar berasal dari biaya yang dibebankan kepada pengirim dan penerima—mencerminkan kompleksitas dan intermediasi dari infrastruktur tradisional, yang efektif bertindak sebagai pajak bagi bisnis dan rumah tangga global.

Hari ini, transfer kawat internasional dapat dikenakan biaya hingga $50 per transaksi, dengan perantara di sepanjang jalur pembayaran sering menambahkan biaya tambahan. Menurut data Bank Dunia, biaya rata-rata global untuk mengirim $200 berada pada 6.65% di Q2 2024. Selain itu, konversi mata uang asing memperkenalkan tantangan lebih lanjut, membawa biaya forex yang mahal dan volatilitas harga.

Proses penyelesaian yang terfragmentasi dalam sistem perbankan koresponden terus memberikan beban ekonomi yang signifikan bagi bisnis dan masyarakat. Importir dan pembeli sering menunggu berhari-hari untuk pembayaran diselesaikan, melemahkan arus kas mereka dan mempersulit perencanaan likuiditas. Eksportir dan penjual menghadapi jendela penyelesaian multi-hari yang tidak terduga, memaksa mereka untuk lebih bergantung pada pinjaman modal kerja jangka pendek yang mahal untuk menjaga operasional. Penerima yang bergantung pada pengiriman uang lintas batas untuk makanan, tempat tinggal, dan kebutuhan lainnya berisiko mengalami sebagian besar pendapatan mereka tergerus oleh perantara tradisional sambil juga menanggung keterlambatan pembayaran—dan dalam beberapa kasus, mereka mungkin harus menangani uang tunai di lingkungan yang rentan terhadap kejahatan, menambah risiko lebih lanjut.

(Dolar Digital di Internet Nilai - Laporan Ekonomi Pasar USDC 2025)

2.2 Transformasi Telah Tiba

Perubahan sudah seharusnya dilakukan. Meskipun internet hampir mengubah setiap aspek perdagangan global selama beberapa dekade terakhir, pergerakan modal masih bergantung pada jaringan tradisional yang terfragmentasi yang kurang transparan, efisien, dan inovatif. Meskipun beberapa negara telah berhasil mengimplementasikan sistem pembayaran real-time nasional, solusi-solusi ini tidak dapat ditingkatkan secara global dan menawarkan aksesibilitas terbatas bagi para pengembang.

Sejak munculnya pesan pembayaran awal dan sistem penyelesaian seperti ACH setengah abad yang lalu, teknologi komunikasi global telah maju hingga pada titik di mana orang di seluruh dunia kini dapat terhubung secara instan. Saat ini, miliaran orang dapat menonton film di ponsel mereka saat naik kereta bawah tanah, mengakses seluruh pengetahuan manusia secara instan dengan biaya hampir tidak ada, dan membeli atau menjual hampir semua produk dari seluruh dunia.

Sekarang saatnya untuk mengadopsi cara baru dalam pergerakan uang secara global—yang beroperasi 24/7, terhubung secara mulus, dan dirancang untuk menghilangkan ketidak efisienan dari sistem pembayaran tradisional sambil membangun dan mengintegrasikan dasar-dasar kokoh dari sistem keuangan tradisional.

(Dolar Digital di Internet Nilai - Laporan Ekonomi Pasar USDC 2025)

Lapisan Penyelesaian Moneter Berbasis Internet 2.3 — Jaringan Pembayaran Circle

Dengan peluncuran Jaringan Pembayaran Circle (CPN), visi ini menjadi kenyataan. Jaringan Pembayaran Circle (CPN) adalah lapisan protokol yang sepenuhnya baru, dibangun di atas sistem penyelesaian yang komprehensif, terbuka, dan berbasis internet, berpusat di sekitar USDC, EURC, dan stablecoin pembayaran yang diatur di masa depan. Dengan menghubungkan platform terbuka skala global dan mengurangi perantara, CPN memungkinkan pergerakan dana dengan cara yang tidak dapat dicapai oleh jaringan tertutup tradisional.

Pentingnya, CPN tidak langsung mentransfer dana; sebaliknya, ia berfungsi sebagai pasar untuk lembaga keuangan dan bertindak sebagai protokol koordinasi untuk memfasilitasi aliran dana global yang lancar dan pertukaran informasi.

CPN mewakili kombinasi pertama aset penyelesaian yang diatur (dalam bentuk stablecoin) dengan lapisan koordinasi dan tata kelola yang dirancang khusus untuk lembaga keuangan. Integrasi ini menghubungkan sistem pembayaran tradisional dengan aset seperti USDC dan EURC, sambil membentuk kerangka mitra terpercaya untuk memungkinkan penyelesaian global yang lebih efisien, kurang diintermediasi.

Dengan memperkenalkan lapisan kliring baru berbasis kepatuhan yang beroperasi 24/7 untuk dolar digital, CPN menetapkan dasar untuk penyelesaian lintas batas skala internet.

(https://x.com/circle/status/1914411337683480654)

2.4 Manfaat Jaringan Pembayaran Circle

Layanan Pembayaran Keuangan Internet

CPN akan memberikan manfaat bagi miliaran orang dan puluhan juta bisnis, memungkinkan mereka mengakses dana dan layanan keuangan sama seperti mengakses layanan internet global yang transformatif lainnya. Pembayar dapat memilih untuk memulai pembayaran menggunakan fiat atau stablecoin, sementara penerima (baik bisnis maupun individu) dapat memilih untuk menyimpan stablecoin atau mengonversinya menjadi mata uang lokal setelah menerima. CPN akan membuat pembayaran instan dan tanpa batas menjadi kenyataan yang luas.

Peluncuran CPN membuat lebih mudah untuk membayangkan masa depan di mana pemasok internasional dapat menerima pembayaran lintas batas hampir instan dan dengan biaya rendah melalui platform modern yang mendukung rantai pasok global; pedagang kecil dapat menerima pembayaran hampir secara real time tanpa biaya berat yang menggerus margin mereka; penjual global dapat langsung mengakses pasar baru; pencipta konten dapat menerima pembayaran mikro dari konsumen, memanfaatkan efisiensi biaya stablecoin; dan penerima remitansi dapat mengambil bagian lebih besar dari dana yang dikirim, meningkatkan daya beli di mana dibutuhkan.

Mengurangi Kompleksitas Teknis

Selain berfungsi sebagai upgrade untuk banyak jaringan pembayaran antar lembaga saat ini, yang sering kali dibebani oleh infrastruktur warisan, ekosistem tertutup, dan penyelesaian yang lambat atau mahal, CPN dirancang sebagai lapisan orkestrasi berbasis stablecoin dan blockchain modern untuk mencapai skala.

Meskipun pembayaran berbasis blockchain telah mulai mendapatkan sedikit perhatian, mereka tidak secara inheren bebas gesekan atau dipercayai—terutama dalam pengaturan antar-lembaga di mana jaminan penyelesaian, reversibilitas, kepatuhan, protokol standar, dan keamanan yang kuat sangat penting. CPN lebih lanjut mengurangi kompleksitas teknis dan meminimalkan hambatan operasional dan keuangan yang selama ini menghambat stablecoin untuk memasuki pembayaran dan perdagangan utama, membuka jalan bagi ekosistem keuangan yang lebih efisien, inklusif, inovatif, dan transparan.

Pengurangan Biaya dan Peningkatan Efisiensi

Dari sudut pandang biaya dan efisiensi, CPN adalah alternatif yang kuat untuk pembayaran lintas batas tradisional. Meskipun ada biaya yang terkait dengan pembelian stablecoin dan mengubahnya kembali menjadi fiat, "on/off-landai" ini menjadi lebih murah di banyak pasar di luar AS dan bisa lebih rendah daripada memperoleh dolar melalui bank.

Transfer dolar tradisional bisa mahal dan lambat baik untuk pengirim maupun penerima, meningkatkan ketergantungan pada pembiayaan modal kerja jangka pendek (seperti yang disebutkan sebelumnya). Dengan memungkinkan penyelesaian hampir instan dan mengurangi ketergantungan pada perantara, CPN dapat membuka efisiensi biaya yang signifikan.

Selain itu, sebagai platform terbuka, CPN memiliki potensi untuk mendorong pasar yang kompetitif untuk on/off-ramps, pertukaran asing, dan layanan lainnya, lebih lanjut menurunkan biaya dan meningkatkan akses.

Transparansi, Keamanan, dan Skalabilitas

CPN adalah infrastruktur yang transparan, aman, dan dapat ditingkatkan yang dirancang untuk membantu lembaga keuangan melayani lebih baik bisnis dan klien konsumennya. Secara krusial, CPN akan membuka efisiensi ini tanpa mengorbankan kepatuhan. Circle telah menetapkan kerangka tata kelola yang kuat untuk CPN, yang mensyaratkan lembaga keuangan peserta untuk memenuhi standar pencucian uang, pembiayaan teroris (AML/CFT), dan sanksi ekonomi global.

E. Infrastruktur Terbuka Mendorong Inovasi

Yang penting, CPN tidak langsung mentransfer dana; sebaliknya, itu bertindak sebagai pasar untuk lembaga keuangan dan berfungsi sebagai protokol koordinasi untuk memfasilitasi aliran dana global yang lancar dan pertukaran informasi. Sebagai operator jaringan, Circle mendefinisikan protokol CPN dan menyediakan API, SDK pengembang, dan kontrak pintar publik untuk mengkoordinasikan aliran dana global.

Pertumbuhan dan kesuksesan CPN tidak akan terbatas pada ekosistem Circle tetapi juga akan bergantung pada partisipan di luar Circle untuk secara bersama-sama membuka nilai ekonomi. Jaringan ini akan menciptakan tanah subur bagi bank, perusahaan pembayaran, penyedia jalan masuk/keluar, pengembang aplikasi, dan penerbit stablecoin yang diatur lainnya untuk berinovasi bersama, memberikan nilai yang lebih besar dan pengalaman yang lebih baik kepada pelanggan mereka sendiri.

Dibangun di atas infrastruktur blockchain publik terbuka, CPN dan stablecoin pembayaran yang diatur menawarkan landasan yang kuat bagi para pengembang untuk meluncurkan aplikasi on-chain yang memindahkan dana dengan lancar di seluruh jaringan tersebut.

CPN menyediakan inovator dan pembangun dengan komponen modular untuk mengembangkan pengalaman pengguna baru dan mendukung berbagai kasus penggunaan pembayaran. Seiring berjalannya waktu, para pembangun akan dapat membuat ekosistem modul yang beragam dan layanan aplikasi di atas CPN - membangun pasar fungsionalitas pihak ketiga untuk peserta CPN dan pengguna akhir, sambil membuka platform distribusi baru dan kuat untuk pengembang fintech.

3. Visi Lingkaran

Melalui Jaringan Pembayaran Circle (CPN), Circle sedang membangun platform dan ekosistem jaringan baru yang menciptakan nilai bagi setiap pemangku kepentingan dalam ekonomi global, membantu mempercepat manfaat dari sistem keuangan baru berbasis internet ini bagi masyarakat:

Usaha:

Importir, eksportir, pedagang, dan perusahaan besar dapat memanfaatkan lembaga keuangan yang didukung oleh CPN untuk menghilangkan biaya dan gesekan yang signifikan, memperkuat rantai pasokan global, mengoptimalkan operasi manajemen kas, dan mengurangi ketergantungan pada pembiayaan modal kerja jangka pendek yang mahal.

Individu:

Pengirim dan penerima uang kirim, pencipta konten, dan orang lain yang sering mengirim atau menerima pembayaran kecil akan mendapatkan nilai yang lebih besar. Institusi keuangan yang menggunakan CPN dapat menyediakan layanan yang ditingkatkan ini dengan lebih cepat, lebih murah, dan lebih sederhana.

Pembangun Ekosistem:

Perbankan, perusahaan pembayaran, dan penyedia lainnya dapat memanfaatkan layanan platform CPN untuk mengembangkan kasus penggunaan pembayaran inovatif, menggunakan pemrograman stablecoin, SDK (kit pengembangan perangkat lunak), dan kontrak pintar untuk membuat ekosistem yang berkembang. Seiring waktu, ini akan sepenuhnya membuka potensi pembayaran stablecoin untuk bisnis dan individu. Selain itu, pengembang pihak ketiga dan bisnis dapat memperkenalkan layanan bernilai tambah untuk memperluas kemampuan jaringan.

Semua peserta dan pengguna akhir jaringan CPN akan mendapatkan manfaat dari infrastruktur pergerakan dana yang terbuka dan terus dapat ditingkatkan, yang tidak hanya menurunkan biaya dan meningkatkan kecepatan pembayaran lintas batas tetapi juga memastikan kesiapan teknologi sistem keuangan internet.

(www.circle.com/cpn)

4. Kasus Penggunaan

Jaringan Pembayaran Lingkaran (CPN) dirancang untuk memungkinkan transaksi yang mulus, efisien, dan aman menggunakan stablecoin yang diatur di jaringan blockchain yang didukung, sehingga mendukung berbagai kasus penggunaan pembayaran dan transfer nilai.

Arsitektur yang berorientasi pada kepatuhan memungkinkan lembaga keuangan asal (OFI) untuk menemukan dan terhubung dengan lembaga keuangan penerima (BFI) melalui CPN, sambil memberdayakan pembangun ekosistem untuk mengembangkan solusi inovatif bagi individu, bisnis, dan lembaga.

(www.circle.com/cpn)

4.1 Pembayaran Bisnis

Pembayaran Pemasok A.

Dengan mempersingkat waktu penyelesaian dan menghilangkan perantara, pembayaran lintas batas antar perusahaan dipercepat dan disederhanakan.

Perusahaan manufaktur yang berbasis di Meksiko perlu melakukan pembayaran ke pemasok baja di Jerman tetapi ingin menghindari biaya pertukaran mata uang asing yang tinggi dan berbagai hari transfer bank. Institusi keuangan asal perusahaan (OFI) menukar peso Meksiko (MXN) dengan USDC dan menggunakan CPN untuk terhubung dengan institusi keuangan penerima (BFI) di Jerman. BFI kemudian dengan lancar mengonversi USDC menjadi euro dan menyelesaikan pembayaran ke rekening pemasok secara instan.

B. Pembayaran Ritel

Meningkatkan perdagangan online global melalui opsi pembayaran yang aman, efisien, dan fleksibel.

Sebuah pengecer fesyen yang berbasis di Brasil menjual barang ke pelanggan di Amerika Serikat. BFI pengecer terhubung dengan OFI melalui CPN untuk menerima pembayaran dalam dolar AS. OFI mengonversi dolar menjadi USDC dan mengirimkannya ke BFI, yang kemudian dengan lancar menukarkan USDC menjadi real Brasil (BRL), atau menyimpannya sebagai USDC dengan penjaga aset digital atas nama pengecer. Pengecer menerima dana secara instan, dengan waktu penyelesaian yang lebih cepat dibandingkan dengan prosesor pembayaran tradisional, dan memiliki opsi untuk menyimpan modal kerja sebagai dolar digital.

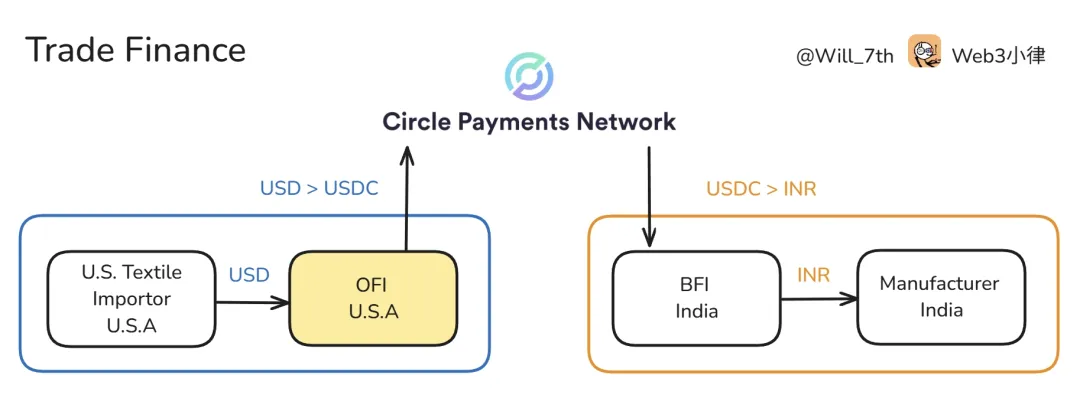

C. Perdagangan Keuangan

Mempermudah dan mengamankan pembayaran perdagangan internasional.

Seorang importir tekstil di Amerika Serikat memesan dari produsen di India, dengan tujuan mengurangi waktu dan biaya pembiayaan perdagangan tradisional. OFI importir mengonversi dolar AS (USD) menjadi USDC dan terhubung dengan BFI di India melalui CPN untuk mentransfer dana. BFI mengelola escrow USDC melalui kontrak pintar, dan setelah memverifikasi dokumen pengiriman, menyelesaikan pembayaran dalam rupee India (INR) kepada produsen. Metode ini mencapai penyelesaian yang lebih cepat, mengurangi risiko pihak lawan, dan memanfaatkan inovasi kontrak pintar untuk layanan escrow.

D. Penyaluran Gaji dan Gaji

Memungkinkan bisnis untuk memproses pembayaran gaji global dengan biaya minimal dan penyelesaian instan.

Sebuah perusahaan multinasional membayar gaji kepada karyawan remote di beberapa negara. Alih-alih mengandalkan saluran perbankan tradisional, perusahaan mengonversi mata uang lokal menjadi USDC melalui OFI-nya dan menggunakan beberapa BFIs yang ditemukan melalui CPN untuk segera mencairkan gaji kepada karyawan. BFIs ini menerima USDC dari OFI dan menyelesaikan pembayaran akhir dalam mata uang lokal masing-masing karyawan.

Pembayaran Kecerdasan Buatan (Pembayaran AI)

Di masa depan, CPN akan mendukung agen AI otonom untuk mengirim dan menerima pembayaran atas nama pengguna atau sistem, memungkinkan pertukaran nilai secara real-time.

Perusahaan logistik menggunakan agen AI untuk melakukan pemesanan layanan pengiriman lintas batas. Ketika agen memilih penyedia layanan di Singapura, ia menggunakan OFI yang terintegrasi dengan CPN untuk mengonversi USD ke USDC dan secara otomatis mengirim pembayaran ke BFI di Singapura, yang kemudian mengonversinya menjadi dolar Singapura (SGD). Seluruh proses pembayaran dilaksanakan secara programatis melalui kontrak pintar, meminimalkan intervensi manual dan memungkinkan pembayaran mesin-ke-mesin lintas batas yang cerdas.

4.2 Pembayaran Konsumen

A. Pengiriman uang

Memberdayakan individu dengan layanan pengiriman uang yang cepat dan hemat biaya, menghindari biaya tinggi dan keterlambatan.

Seorang pengguna yang tinggal di Amerika Serikat ingin mengirim uang ke keluarganya di Filipina. Perusahaan pengiriman uang, yang bertindak sebagai OFI di AS, mengonversi USD menjadi USDC dan secara bersamaan menggunakan CPN untuk secara dinamis menemukan BFI lokal di Filipina, yang mengonversi USDC menjadi Peso Filipina (PHP), mengirimkan dana ke keluarga hampir secara real-time, dengan biaya hanya sebagian kecil dari biaya pengiriman tradisional.

B. Langganan

Mendukung pembayaran reguler untuk layanan digital dengan penagihan stablecoin yang dapat diprogram.

Platform media digital menawarkan layanan langganan premium kepada pengguna di seluruh dunia. Setiap bulan, dompet digital pengguna memulai pembayaran USDC melalui lembaga keuangan asal (OFI), yang dirutekan melalui BFI platform yang ditemukan melalui CPN. BFI menerima dana dan entah menyimpannya sebagai USDC dengan penitip aset digital atas nama platform media atau mengonversinya menjadi mata uang fiat lokal sesuai kebutuhan, mengkredit akun platform media.

C. Pembayaran Mikro dan Monetisasi Konten

Mendukung pembayaran mikro instan dan murah untuk pembuat konten dan layanan digital.

Seorang pembuat konten di Brasil menerima sumbangan kecil dari penggemar global melalui CPN, menggunakan OFI lokal dan didukung oleh BFI. Penggemar dapat mengirim stablecoin secara instan tanpa keterlambatan yang lama atau biaya platform yang tinggi, memungkinkan monetisasi yang cepat dan murah.

D. E-commerce

Meningkatkan akses konsumen ke pasar online global dengan pengalaman pembayaran yang cepat.

Seorang pelanggan di Inggris membeli produk elektronik dari penjual di Korea Selatan melalui platform e-commerce internasional. Saat checkout, pelanggan melakukan pembayaran dalam GBP melalui OFI lokal, yang mengonversi dana menjadi USDC dan mentransfernya ke BFI di Korea Selatan. BFI mengonversi USDC menjadi Korean Won (KRW) dan mendepositokannya ke rekening penjual.

4.3 Pembayaran Institusional

Penyelesaian Pasar Modal A.

Memungkinkan penyelesaian yang lebih cepat dan transparan antara lembaga keuangan, mengurangi risiko pihak lawan dan biaya operasional, sehingga meningkatkan efisiensi perdagangan.

Sebuah perusahaan manajemen aset AS melakukan perdagangan obligasi over-the-counter (OTC) dengan bank investasi Eropa tetapi ingin menghindari keterlambatan penyelesaian T+2, serta ketidakefisienan modal yang timbul dan risiko kontra pihak. Institusi keuangan asal perusahaan manajemen aset (OFI) mengonversi USD menjadi USDC dan menggunakan CPN untuk terhubung dengan institusi keuangan penerima Eropa (BFI) untuk mentransfer USDC. BFI kemudian segera menyelesaikan transaksi dalam euro (EUR) dengan bank investasi.

B. Valuta Asing (FX)

Meningkatkan efisiensi operasi multi-kurensi, menyederhanakan pertukaran kurensi, dan mengatasi tingginya tarif valuta asing, kompleksitas manajemen multi-kurensi, dan penundaan yang biasanya terkait dengan penyedia.

Sebuah perusahaan investasi Eropa ingin mendanai akuisisi real estat di Jepang tetapi ingin menghindari biaya pertukaran asing tinggi dan keterlambatan. OFI perusahaan investasi mengonversi euro (EUR) menjadi EURC, yang ditukar dengan lancar menjadi yen Jepang (JPY) di tempat FX kompetitif melalui CPN setelah diterima oleh BFI di Jepang, menyelesaikan transaksi tersebut secara langsung.

Layanan Keuangan dan Kas

Mengonversi pendapatan luar negeri kembali ke pasar dalam negeri dengan efisien, menyederhanakan repatriasi dana.

Sebuah penyedia perangkat lunak perusahaan yang berbasis di AS menawarkan solusi berbasis cloud kepada bisnis di seluruh Asia Tenggara. Untuk repatriasi pendapatan wilayah tersebut ke AS, lembaga keuangan penerima manfaat (BFI) perusahaan di AS menemukan lembaga keuangan asal lokal (OFI) di Filipina melalui CPN. OFI mengumpulkan pembayaran dalam peso Filipina (PHP) dari klien bisnis, mengonversinya menjadi USDC, dan mentransfernya ke BFI AS. BFI kemudian mengonversi USDC menjadi USD dan mendepositokannya ke rekening kas perusahaan, memfasilitasi konsolidasi pendapatan global yang lebih cepat dan sesuai peraturan.

Pembayaran Pemerintah dan Kemanusiaan

Menyediakan saluran pembayaran berukuran besar yang aman, dapat diandalkan, dan efisien, mulai dari dana bantuan bencana hingga transfer institusional.

Sebuah LSM internasional menggunakan stablecoin untuk mendistribusikan dana bantuan bencana. LSM tersebut memulai pembayaran melalui lembaga keuangan asalnya (OFI), yang mengonversi mata uang lokal menjadi USDC dan mentransfernya ke lembaga keuangan penerima manfaat (BFI) yang beroperasi di wilayah terdampak. BFI entah langsung mengirimkan dana ke dompet digital penerima manfaat atau mengonversi USDC menjadi mata uang lokal dan mendepositkannya ke rekening bank mereka, memastikan transparansi, mempercepat pengiriman dana, dan meningkatkan akuntabilitas dalam distribusi bantuan.

E. Integrasi Keuangan Terdesentralisasi (Integrasi DeFi)

Mendukung inovator DeFi dengan menyediakan dasar untuk peminjaman, pinjaman, tabungan, dan lainnya, membuka potensi keuangan on-chain mainstream.

Platform pinjaman DeFi yang berlisensi dan diatur dengan baik mengintegrasikan USDC dan EURC untuk menawarkan produk pinjaman dan tabungan. Dengan infrastruktur yang disediakan oleh CPN, platform memfasilitasi transaksi lintas batas yang lancar, mengurangi volatilitas, dan mendukung aliran pelanggan institusional yang patuh sambil membangun kepercayaan di antara beragam pengguna.

5. Pemangku Kepentingan dan Peran Ekosistem CPN

Ekosistem CPN terdiri dari pemangku kepentingan dan peserta ekosistem yang memainkan peran penting dalam memfasilitasi pembayaran global, mendorong inovasi teknologi, dan memajukan tata kelola jaringan, penciptaan nilai ekonomi, dan adopsi jaringan.

5.1 Badan Tata Kelola CPN

Circle berfungsi sebagai badan utama pengaturan dan penetapan standar untuk CPN, serta operator jaringan.

Tugas utama Circle termasuk:

Menetapkan dan memelihara "Aturan Jaringan Pembayaran Lingkaran" ("Aturan CPN"), yang mengatur kualifikasi, operasi, dan kepatuhan semua peserta.

Mengembangkan dan memelihara infrastruktur inti—kontrak pintar, API, dan SDK—untuk memungkinkan penyelesaian pembayaran yang lancar (mengirim/menerima transaksi) di seluruh jaringan blockchain.

Protokol koordinasi operasional untuk anggota dan penemuan harga, routing pembayaran, dan penyelesaian antara pihak-pihak yang berkepentingan.

Mempromosikan berbagi informasi yang terstandarisasi dan otomatis di antara anggota untuk memastikan kepatuhan dengan Aturan Perjalanan.

Memverifikasi kualifikasi lembaga keuangan, menyetujui partisipasi mereka dalam jaringan, dan mengeluarkan sertifikat yang mengkonfirmasi kepatuhan terhadap standar CPN mengenai lisensi, anti pencucian uang (AML), kontra pendanaan terorisme (CFT), kepatuhan sanksi, dan kekuatan keuangan.

Mengawasi kepatuhan anggota terhadap persyaratan regulasi (termasuk AML/CFT dan sanksi) melalui tinjauan berbasis risiko yang berkelanjutan.

Merencanakan dan mengelola keamanan jaringan, respons insiden, dan infrastruktur untuk memastikan integritas operasional dan ketahanan.

Memperkenalkan penyedia layanan pihak ketiga yang disetujui sebelumnya dan aplikasi modular yang memenuhi standar kepatuhan, keamanan, dan kinerja CPN.

5.2 Anggota CPN

Anggota, juga dikenal sebagai Institusi Keuangan Peserta (PFIs), adalah batu penjuru CPN. Mereka bertindak sebagai kontra pihak, menginisiasi, memfasilitasi, atau menerima pembayaran dalam jaringan dan menjalankan transaksi sesuai dengan aturan CPN dan standar tata kelola.

PFIs termasuk Penyedia Jasa Aset Virtual (VASPs), Penyedia Layanan Pembayaran tradisional dan kripto-natif (PSPs), dan lembaga keuangan seperti bank tradisional atau digital. Bergantung pada peran mereka dalam transaksi, PFIs dapat bertindak sebagai Institusi Keuangan Asal (OFIs), menginisiasi pembayaran atas nama pengirim, atau sebagai Institusi Keuangan Penerima (BFIs), menerima pembayaran stablecoin dan memfasilitasi pembayaran fiat akhir melalui sistem pembayaran lokal, atau menyediakan layanan penyimpanan stablecoin atas nama penerima.

Tanggung jawab inti anggota CPN termasuk:

Memelihara lisensi yang sesuai dan memastikan kepatuhan yang berkelanjutan dengan semua regulasi yang relevan di yurisdiksi yang berlaku, termasuk Anti-Pencucian Uang dan Pencegahan Pendanaan Terorisme (AML/CFT) dan persyaratan sanksi, sambil mematuhi aturan CPN.

Berpartisipasi dalam proses kualifikasi Circle dan menjaga informasi entitas hukum, status kepatuhan, lingkup yurisdiksi, dan profil risiko tetap terkini.

Melakukan penilaian berbasis risiko terhadap pihak ketiga dan transaksi berdasarkan kewajiban kepatuhan dan informasi yang dikumpulkan serta pengawasan yang dilaksanakan melalui CPN.

Melaksanakan pembayaran sesuai dengan layanan teknis dan protokol yang diuraikan dalam aturan CPN, tergantung pada peran mereka sebagai OFI atau BFI.

Mematuhi persyaratan teknis dan infrastruktur CPN, termasuk integrasi yang aman, kinerja Perjanjian Tingkat Layanan (SLA), pemantauan transaksi, dan protokol perlindungan data.

Berbagi informasi pengirim dan penerima yang diperlukan sesuai dengan kerangka kepatuhan Aturan Perjalanan CPN, Permintaan Informasi (RFI), dan permintaan pengawasan lainnya.

Memantau transaksi untuk mendeteksi dan melaporkan aktivitas mencurigakan sesuai dengan regulasi yang berlaku.

Terlibat dalam tata kelola CPN melalui umpan balik terstruktur, tinjauan operasional, dan peringkat reputasi anggota untuk meningkatkan transparansi dan mendukung perbaikan berkelanjutan.

Memberikan dukungan dan solusi tepat waktu kepada anggota atau pengguna lain mengenai pertanyaan terkait jaringan.

Menggunakan SDK pengembang CPN, stablecoin yang diatur, dan infrastruktur kontrak cerdas untuk mengembangkan dan menyampaikan kasus penggunaan pembayaran inovatif.

5.3 Pengguna Akhir CPN (Perusahaan dan Individu)

Pengguna akhir adalah inisiator dan penerima manfaat akhir dari transaksi pembayaran—meskipun mereka tidak berinteraksi langsung dengan CPN, mereka mendapat manfaat dari biaya lebih rendah, penyelesaian yang lebih cepat, transparansi yang lebih besar, dan inovasi yang berkelanjutan. Pengirim memulai pembayaran melalui Institusi Keuangan Asal (OFI), sementara penerima menerima pembayaran melalui Institusi Keuangan Penerima (BFI).

5.4 Penyedia Layanan CPN

Entitas-entitas ini mencakup baik lembaga keuangan (LK) maupun lembaga non-keuangan (bukan LK) yang menyediakan solusi teknologi bernilai tambah dan layanan keuangan kepada anggota CPN dan pengguna akhir.

Mereka termasuk:

Penyedia Likuiditas dan Platform Forex: Entitas ini menyediakan pembuatan pasar yang efisien, penemuan harga, dan layanan pertukaran mata uang untuk transaksi stablecoin dalam CPN. Mereka menyediakan likuiditas untuk penyelesaian stablecoin lintas batas dan memastikan tingkat pertukaran mata uang asing yang kompetitif.

Penerbit Stablecoin: Institusi-institusi ini menerbitkan stablecoin pembayaran yang diatur, yang berfungsi sebagai medium pertukaran utama dalam CPN. Penerbit stablecoin memastikan cadangan yang transparan, kepatuhan regulasi, dan likuiditas fiat yang mendasari untuk mendukung transaksi lintas batas yang lancar.

Penyedia Solusi Teknologi dan Layanan Keuangan: Penyedia layanan ini menawarkan berbagai layanan kepada anggota CPN, termasuk manajemen penipuan dan risiko, infrastruktur dompet, solusi kustodian, penagihan dan faktur, serta kepatuhan dan solusi pemantauan transaksi untuk mendukung kebutuhan bisnis dan operasional mereka.

(www.circle.com/cpn)

6. Tata Kelola CPN, Kualifikasi, dan Operasi Jaringan

CPN beroperasi dalam kerangka tata kelola kolaboratif dan transparan yang bertujuan untuk memprioritaskan kepatuhan, keamanan, dan kepercayaan dalam jaringan. Kerangka kerja ini mencakup tiga aspek kunci tata kelola:

Tinjauan dan Pengawasan Kualifikasi: Circle, sebagai badan pengatur utama, bertanggung jawab untuk menetapkan standar kualifikasi yang ketat, yang dirinci dalam "Aturan Jaringan Pembayaran Lingkaran," dan mempromosikan integrasi stablecoin pembayaran yang diatur ke dalam jaringan.

Fungsi dan Operasi Jaringan: Fungsi inti mendukung transaksi yang lancar dan sesuai aturan sambil memastikan ketatnya operasional dan peningkatan yang berkelanjutan.

Transparansi dan Keterlibatan Pemangku Kepentingan: Dengan berinteraksi secara aktif dengan berbagai pemangku kepentingan, termasuk lembaga keuangan, regulator, perusahaan, dan pembangun, CPN selaras dengan standar global untuk meningkatkan kepercayaan, mempercepat adopsi, dan mendorong pertumbuhan ekosistem jaringan yang berkelanjutan.

Operasi Jaringan:

Hanya lembaga keuangan yang sah diizinkan.

Kepatuhan anti pencucian uang (APU), pencegahan pendanaan terorisme (PPT), dan kepatuhan terhadap sanksi wajib.

Berbagi data transaksi yang aman, termasuk Aturan Perjalanan.

Pemeriksaan dan pengawasan berkelanjutan.

6.1 Tinjauan Kualifikasi dan Pengawasan

Kerangka tata kelola CPN menentukan standar kualifikasi, protokol sertifikasi, dan integrasi stablecoin teratur untuk memastikan partisipasi yang kredibel dari lembaga keuangan, penerbit stablecoin teratur, dan penyedia layanan dalam jaringan.

Standar Kualifikasi Ketat

Anggota harus memenuhi persyaratan kualifikasi komprehensif sebelum mendapatkan akses jaringan. Ini termasuk memegang semua lisensi yang diperlukan, menerapkan program anti pencucian uang (APU) dan langkah-langkah sanksi sesuai dengan peraturan lokal dan standar global, menjaga kontrol keamanan yang wajar, dan menunjukkan kekuatan keuangan yang memadai. Sebagai operator jaringan, Circle menilai semua calon anggota sebelum memberikan akses dan secara berkala mengevaluasi mereka berdasarkan risiko. Anggota yang dilisensikan di bawah kerangka regulasi yang kokoh yang dibuat oleh badan-badan kepatuhan internasional, seperti Financial Action Task Force (FATF), akan menjalani tinjauan standar, sementara anggota lain mungkin akan tunduk pada evaluasi lebih mendalam. Standar kualifikasi tersebut tersedia untuk umum, dan penilaian Circle dapat berfungsi sebagai masukan untuk proses dilijensi kontra pihak anggota sendiri.

Sertifikasi Anggota dan Akses

Setelah verifikasi kualifikasi dan persetujuan berhasil, CPN mengeluarkan sertifikasi jaringan unik kepada anggota yang memenuhi syarat. Sertifikasi ini memungkinkan pihak-pihak yang berkepentingan untuk mengidentifikasi satu sama lain secara aman dan mengambil informasi pihak-pihak lain, memfasilitasi transparansi, memungkinkan penilaian risiko yang terinformasi, dan meningkatkan efisiensi proses pemeriksaan pihak-pihak lain. Sertifikasi ini mencakup serangkaian atribut yang jelas dan terdefinisi dengan baik—seperti status keanggotaan, cakupan yurisdiksional, dan informasi kualifikasi—yang terus dipantau dan diperbarui untuk mencerminkan perubahan dalam lanskap risiko.

C. Integrasi Stablecoin Pembayaran Terregulasi

Kerangka tata kelola CPN menguraikan proses evaluasi dan persetujuan terstruktur untuk mengintegrasikan stablecoin pembayaran teratur baru yang diatur ke dalam CPN. Stablecoin potensial harus menjalani penilaian yang ketat berdasarkan standar kualifikasi CPN yang ketat, termasuk kepatuhan regulasi, cadangan transparan dan bukti audit, ketersediaan saluran pembayaran perbankan, likuiditas fiat yang mendasari, standar manajemen risiko, kemampuan keamanan informasi dan jaringan, dan praktik pelaporan. Hanya stablecoin yang sepenuhnya memenuhi standar ini dan menerima persetujuan dari badan tata kelola yang dapat beroperasi dalam jaringan, memastikan bahwa mereka berkontribusi pada ekosistem jaringan yang stabil, aman, dan efisien.

6.2 Fungsi dan Operasi Jaringan

CPN beroperasi melalui kerangka kerja yang kuat yang memungkinkan anggota melakukan transaksi secara aman dan real-time, memastikan konsistensi, skalabilitas, dan ketahanan. Kerangka kerja ini mencakup koordinasi transaksi, dukungan operasional, respons insiden, dan manajemen infrastruktur.

A. Koordinasi Transaksi dan Manajemen Risiko

Transaksi dalam CPN dikoordinasikan melalui serangkaian layanan teknis dan protokol, memastikan pelaksanaan yang lancar di antara anggota yang berpartisipasi. Selain itu, anggota jaringan memanfaatkan peringatan otomatis yang disediakan oleh CPN dan melakukan penilaian risiko secara teratur untuk terus memantau aliran transaksi, berfokus pada anomali transaksi dan kinerja mitra, seperti mengevaluasi tingkat transaksi gagal dan pelanggaran perjanjian tingkat layanan (SLA). Langkah-langkah ini secara proaktif mengurangi risiko operasional, membantu menjaga keandalan dan efisiensi jaringan.

Dukungan Operasional Anggota

CPN menyediakan panduan operasional yang jelas, termasuk perjanjian tingkat layanan (SLA) yang didefinisikan dalam aturan CPN, yang menjelaskan harapan untuk waktu aktivitas, kecepatan transaksi, penyelesaian sengketa, dan berbagi informasi tepat waktu. Jaringan juga menstandardisasi pertukaran data transaksi dan pihak lawan, menyederhanakan operasi dengan mengurangi kebutuhan koordinasi yang disesuaikan.

C. Manajemen Insiden dan Krisis

CPN telah menetapkan protokol rinci untuk mengelola kejadian keamanan, isu kepatuhan regulasi, dan gangguan sistem. Protokol ini mencakup saluran komunikasi yang telah ditentukan sebelumnya dengan anggota dan proses penyelesaian yang transparan dan adil, memastikan respons cepat dan manajemen perselisihan yang efektif, baik yang terkait dengan kepatuhan maupun transaksi.

Skalabilitas Infrastruktur dan Perencanaan

Infrastruktur CPN terus dimonitor menggunakan alat observabilitas yang melacak throughput, laten, dan tingkat kesalahan. Pemantauan kinerja otomatis dan pengujian beban reguler memungkinkan jaringan untuk berkembang sesuai dengan permintaan. Circle bekerja sama dengan mitra infrastruktur dan cloud yang terverifikasi untuk memastikan konfigurasi yang tangguh untuk sumber daya komputasi dan penyimpanan. Tinjauan skalabilitas dan uji stres tingkat koridor memvalidasi kesiapan jaringan untuk peningkatan volume transaksi dan ekspansi jaringan.

6.3 Transparansi dan Keterlibatan Pemangku Kepentingan

Gubernur CPN dibangun di atas transparansi, yang membantu memupuk kepercayaan dan keyakinan di antara semua peserta. Sebagai badan pemerintah, Circle, di bawah nasihat dari komite penasehat, mengambil rekomendasi strategis untuk memperkuat kerangka tata kelola. CPN secara teratur melakukan survei, kelompok fokus, dan tinjauan terstruktur untuk mengumpulkan umpan balik dari anggota dan menilai kualitas layanan. Masukan ini mendorong perbaikan terus-menerus dan membantu memastikan perkembangan jaringan memenuhi kebutuhan peserta. Audit independen dan laporan publik berkala tentang volume transaksi, waktu aktif sistem, dan kepatuhan anggota lebih lanjut memperkuat integritas operasional dan akuntabilitas.

Perwakilan anggota CPN dan pengguna akhir, serta interaksi dengan regulator, memainkan peran penting dalam pengembangan jaringan. CPN mendorong anggotanya untuk aktif berpartisipasi dalam pembentukan aturan jaringan dan standar teknis, memberikan saran berharga dan wawasan operasional yang membantu membentuk strategi dan pertumbuhan jaringan. Selain itu, departemen layanan keuangan Circle menjaga interaksi yang berkelanjutan dengan regulator global, memanfaatkan catatan kinerja yang kuat untuk memastikan CPN sejalan dengan standar internasional—terutama yang terkait dengan anti pencucian uang (AML), pemberantasan pendanaan terorisme (CFT), dan aturan perjalanan Financial Action Task Force (FATF)—dan beroperasi dalam lingkungan yang aman, terpercaya, dan sesuai.

7. Layanan Inti CPN

CPN, yang dirancang khusus untuk stablecoin, berfungsi sebagai protokol koordinasi yang memungkinkan transaksi global yang lancar, sesuai, dan dapat diprogram.

CPN memanfaatkan jaringan blockchain publik untuk penyelesaian akhir sementara mengoptimalkan koordinasi pembayaran, pertukaran data terkait kepatuhan, dan routing pintar antara stablecoin dan anggota jaringan. Stablecoin adalah kelas aset digital fundamental dalam CPN, menyediakan stabilitas, interoperabilitas, dan programmabilitas yang diperlukan untuk aplikasi keuangan berkepercayaan tinggi.

Pada peluncuran, jaringan mendukung USDC dan EURC, dengan rencana untuk memperluas ke stablecoin pembayaran teratur lainnya yang memenuhi standar governance dan kelayakan ketat CPN. Seiring waktu, CPN akan berfungsi sebagai dasar bagi pengembang untuk membuat modul interoperable dan layanan aplikasi yang akan memperluas kegunaan jaringan dan membuka kasus penggunaan baru untuk pembayaran global dan inovasi keuangan.

7.1 Pembayaran Melalui Koordinasi Pintar

Protokol pembayaran CPN dibangun di atas arsitektur hibrida yang menggabungkan sistem off-chain dan on-chain, membantu menggabungkan likuiditas dan memfasilitasi penemuan harga di antara anggota jaringan. Seiring penambahan lebih banyak stablecoin pembayaran ke jaringan, CPN akan berkembang menjadi infrastruktur routing forex on-chain, memungkinkan pertukaran yang efisien dan langsung antara stablecoin sambil masih mengkoordinasikan penyelesaian transaksi antara Institusi Keuangan Asal (OFIs) dan Institusi Keuangan Penerima (BFIs).

Pada versi awal CPN, koordinasi terjadi melalui sistem API off-chain yang menghasilkan permintaan transaksi. OFI menandatangani permintaan ini untuk memulai transfer USDC atau EURC ke dompet BFI yang ditentukan. Pada tahap ini, Circle (sebagai operator jaringan dan badan tata kelola) menyiarkan transaksi ke blockchain yang sesuai. Proses ini memvalidasi rincian pembayaran, memastikan jumlah dan token yang benar dikirim ke BFI, dan semua biaya terkait ditutupi dalam waktu penyelesaian yang disepakati.

Selanjutnya, CPN akan beralih ke arsitektur protokol kontrak pintar, meningkatkan komposabilitas jaringan dan memperkenalkan fitur yang lebih efisien dan bernilai tambah. Protokol pembayaran kontrak pintar CPN dirancang untuk memungkinkan pembayaran on-chain yang mulus antara anggota menggunakan stablecoin (termasuk USDC dan EURC). Dengan memanfaatkan kontrak pintar, protokol akan meminimalkan kesalahan transaksi, mendukung rekonsiliasi otomatis, dan mengumpulkan biaya secara efisien sambil mempertahankan desain non-kustodial.

Di bawah protokol ini, OFI memulai pembayaran melalui kontrak pintar yang digunakan pada jaringan blockchain publik yang didukung oleh CPN. Kontrak memverifikasi parameter transaksi utama (seperti jenis token, jumlah, alamat penerima, dan tenggat waktu) sebelum melakukan pembayaran. Tidak seperti transfer tradisional yang rawan kesalahan dan memerlukan faktur terpisah untuk biaya transaksi, kontrak pintar memberlakukan pembayaran yang tepat dan secara efisien merutekan transaksi ke BFI yang berbeda dalam kasus yang melibatkan banyak tawaran dan penawaran.

Untuk meningkatkan transparansi dan keamanan, setiap transaksi diidentifikasi secara unik dan diberi stempel waktu, memastikan auditabilitas yang jelas untuk tujuan kepatuhan dan rekonsiliasi. Selain itu, protokol akan menyertakan fitur "undo" opsional di masa mendatang, yang memungkinkan pengirim untuk membatalkan transaksi yang salah dalam waktu singkat sebelum konfirmasi akhir.

(www.circle.com/cpn)

7.2 Mengoptimalkan Forex (FX) dengan Smart Discovery dan Routing

CPN memungkinkan Institusi Keuangan Asal (OFI) yang berpartisipasi untuk menemukan Institusi Keuangan Penerima (BFI) dan mengirim stablecoin untuk penyelesaian pembayaran. Selama proses penemuan, CPN memungkinkan OFI untuk menanyakan jaringan untuk pasangan stablecoin atau mata uang fiat tertentu. Sistem ini memungkinkan OFI untuk menemukan peserta jaringan dan meminta tingkat pertukaran dan likuiditas yang sesuai. Pada awalnya, platform mengintegrasikan USDC dan EURC dengan buku pesanan likuiditas mata uang fiat lokal dan sumber likuiditas pribadi. Seiring waktu, sistem akan beralih ke arsitektur routing, agregasi, dan penyelesaian forex (FX) sepenuhnya on-chain—memberikan akses langsung ke kolam FX on-chain, buku pesanan, dan likuiditas pribadi.

Kemampuan penemuan jaringan akan mencakup routing pesanan, sementara sistem Permintaan Penawaran (RFQ) akan lebih mengoptimalkan eksekusi FX untuk memenuhi standar kinerja sistem pembayaran tradisional.

Meskipun jaringan awalnya berfokus pada menemukan likuiditas antara BFIs, itu akan secara bertahap memperluas untuk memasukkan tempat-tempat on-chain pada daftar putih - seperti Automated Market Makers (AMM), buku pesanan on-chain, dan penyedia likuiditas lainnya - untuk memperluas akses ke likuiditas stablecoin. Begitu ditemukan, CPN akan cerdas mencocokkan pesanan dari sumber-sumber ini, memungkinkan konversi FX stablecoin langsung, dengan langkah-langkah keamanan bawaan dan pelaksanaan transparan, yang dikoordinasikan oleh Circle sebagai operator jaringan.

Pembayaran Penyelesaian Lintas Rantai yang Lancar 7.3

CPN mendukung penyelesaian asli stablecoin di beberapa blockchain, menyediakan mekanisme transfer pembayaran lintas rantai yang mulus. Institusi Keuangan Partisipan (PFIs) membawa blockchain pilihan mereka ke dalam jaringan, sementara CPN mengoordinasikan transaksi antara blockchain sumber dan tujuan yang dipilih untuk memungkinkan penyelesaian pembayaran yang efisien. Dengan Protokol Transfer Lintas Rantai Circle (CCTP versi 2), CPN memfasilitasi transfer lintas rantai yang cepat dan aman untuk stablecoin yang diperbolehkan, memastikan bahwa transaksi mempertahankan kecepatan dan integritas di seluruh jaringan blockchain. Awalnya, platform akan mendukung sejumlah terbatas blockchain saat diluncurkan, dengan rencana untuk memperluas ke lebih banyak blockchain berdasarkan preferensi anggota jaringan di masa depan.

7.4 Transparansi Selektif untuk Melindungi Kerahasiaan

CPN akan memperkenalkan fitur-fitur peningkatan kerahasiaan canggih pada blockchain publik untuk melindungi data transaksi dan membantu anggota memenuhi kewajiban privasi dan operasional. Mekanisme ini memungkinkan pengguna menetapkan transaksi tertentu sebagai rahasia, memastikan bahwa informasi pembayaran sensitif tidak ditampilkan secara permanen pada blockchain publik. Kemampuan ini mendukung berbagai kasus penggunaan, memungkinkan bisnis menjaga kerahasiaan untuk aktivitas penting, seperti pembayaran korporat, pembiayaan perdagangan, dan gaji, melalui CPN.

Selain itu, CPN akan mengadopsi protokol kerahasiaan (yang akan didefinisikan secara terpisah dan tidak termasuk dalam white paper ini) untuk pengungkapan selektif. Di bawah protokol ini, rincian transaksi hanya akan terlihat oleh pihak yang diotorisasi—seperti pihak lawan, agensi penegak hukum, regulator, dan auditor—saat diperlukan untuk kepatuhan atau tujuan hukum.

7.5 Memperluas Kemampuan melalui Komposabilitas dan Interoperabilitas yang Terpercaya

Untuk memperluas nilai ekosistem jaringan, CPN memungkinkan protokol pihak ketiga yang telah disetujui sebelumnya untuk mengintegrasikan dan berinteroperasi dengan infrastruktur inti, meningkatkan praktikabilitas dan fleksibilitas kemampuan pembayarannya. Circle memvisualisasikan berbagai integrasi yang beragam—termasuk pinjaman dan kredit, agregasi likuiditas, hasil institusional, penyimpanan, layanan langganan, dan lainnya. Partisipasi dibatasi hanya untuk protokol yang telah dimasukkan ke dalam daftar putih, diaudit, dan ditinjau secara ketat oleh Circle, dengan mematuhi standar regulasi yang ketat, protokol keamanan, dan praktik manajemen likuiditas. Melalui arsitektur yang dapat disusun ini, CPN bertujuan untuk membuka dasar yang aman, dapat diprogram, dan ekosistem pihak ketiga untuk pembayaran global, layanan keuangan, dan solusi berbasis teknologi.

8. Model Ekonomi CPN

Model ekonomi dan mekanisme insentif CPN dirancang untuk mendorong adopsi awal yang cepat sambil membentuk strategi pendapatan jangka panjang yang berkelanjutan bagi semua peserta jaringan. Ini menyelaraskan insentif di antara semua anggota jaringan, pengguna akhir, pembangun, dan penyedia layanan untuk mempromosikan pertumbuhan dan keberlanjutan jaringan.

Transaksi yang diproses melalui CPN menghasilkan tiga biaya utama:

Biaya Pembayaran: Mengganti Lembaga Keuangan Penerima Manfaat (BFIs) untuk pembayaran fiat lokal dan biaya pemrosesan.

Spread FX: Mencerminkan risiko likuiditas dan biaya konversi mata uang.

Biaya Jaringan CPN: Biaya titik dasar berbasis tiered berbasis negara yang digunakan untuk mendukung fungsi inti jaringan, termasuk kepatuhan, keamanan, infrastruktur, dan pengembangan.

Saat CPN berkembang dan Circle, bersama dengan pengembang pihak ketiga, memperkenalkan layanan tambahan bernilai melalui pasar yang dikurasi, biaya berbasis penggunaan tambahan akan diterapkan untuk mendukung dan memelihara layanan-layanan ini. Layanan-layanan ini mungkin termasuk alat deteksi penipuan, manajemen risiko, infrastruktur dompet, penyimpanan aman, penagihan, dan kemampuan kepatuhan yang canggih. Biaya layanan pihak pertama (1P) dan pihak ketiga (3P) akan menciptakan peluang pendapatan bagi penyedia dan memungkinkan lembaga keuangan untuk menyesuaikan pengalaman pembayaran melalui solusi modular, pasang-dan-mainkan.

Sebagian dari biaya jaringan dan pasar akan diinvestasikan kembali secara strategis ke dalam prioritas inti, seperti peningkatan infrastruktur, penelitian dan pengembangan, operasi jaringan, insentif akuisisi pengguna, dan pertumbuhan ekosistem pengembang—termasuk pendanaan untuk integrasi CPN dan aplikasi baru. Pendekatan reinvestasi ini dirancang untuk meningkatkan ketahanan platform, mendorong inovasi, dan mempercepat ekspansi jaringan jangka panjang.

pernyataan:

Artikel ini diambil dari [ Web3 Xiaolu], hak cipta adalah milik penulis asli [Will Awang], jika Anda memiliki keberatan terhadap cetakan ulang, silakan hubungi Gate Belajartim, dan tim akan menanganinya sesegera mungkin sesuai dengan prosedur yang relevan.

Penyangkalan: Pandangan dan opini yang diungkapkan dalam artikel ini hanya mewakili pandangan pribadi penulis dan tidak merupakan saran investasi apa pun.

Versi bahasa lain dari artikel diterjemahkan oleh tim Gate Learn. Artikel yang diterjemahkan tidak boleh disalin, didistribusikan, atau diplagiatkan tanpa menyebutkanGate.io.

Artikel Terkait

Apa itu Stablecoin?

Penjelasan Mendalam tentang Yala: Membangun Agregator Pendapatan DeFi Modular dengan Stablecoin $YU sebagai Medium

Dolar di Internet Nilai - Laporan Ekonomi Pasar USDC 2025

USDC dan Masa Depan Dolar

Apa itu Carry Trades dan Bagaimana Mereka Bekerja?